Accion is constantly inspired by the entrepreneurs we serve, who dream of creating a better future not only for themselves and their families, but also for their employees, their employees' families, and their communities. In 2016, our members surpassed 60,000 loans and $500 million disbursed since we began lending to U.S. entrepreneurs in 1991. Yet, we know that these numbers only tell a fraction of the story.

Small business owners are key drivers of economic growth – particularly in those communities that were most impacted by the economic recession. Through the Aspen Institute's EntrepreneurTracker, we know that the business owners Accion serves create or sustain three jobs on average and double their take-home pay one year after taking out a loan. These numbers are encouraging, but they don't tell the full story – because it's those intangible impacts, which cannot be captured through numbers alone, that most inspire us. Our members see how entrepreneurs change lives every day, including: creating jobs to help families save for college or buy a home; fostering a strong community spirit among customers and neighbors; providing for their families; and setting their children on a path to success.

The individual stories of small business owners like Mariel, Tequila, Alex, Lauren and Kris are powerful testaments to the value of investing in entrepreneurship, and in our members’ ability to transform loans into opportunity. To understand this impact in a more systematic, holistic manner, our network embarked upon a multi-year, mixed-methods study with fellow mission-based lender Opportunity Fund. We completed the first phase of this first-of-its-kind research in 2016, and look forward to the further insights that will emerge from the final results of the study.

We continue to be alarmed that each day thousands of entrepreneurs go without the financial services and business advising they need to reach their full potential. In 2016 the U.S. Network office’s investments in innovation, made possible through generous lead funding from the Sam’s Club Giving Program and the MetLife Foundation, laid the groundwork for our members to serve tens of thousands more business owners with high-quality lending and advising services. In 2017 Accion will implement the first phase of this effort, the product of tremendous collaboration with best-in-class technology partners – including Salesforce, Cloud Lending and DemystData – and among Accion employees across the country.

We thank you for your continued support. Together, we can unlock the tremendous power of entrepreneurship to drive transformational change in neighborhoods across the country.

Sincerely,

BRAD HENDERSON

Board Chair

Accion, U.S. Network

GINA HARMAN

Chief Executive Officer

Accion, U.S. Network

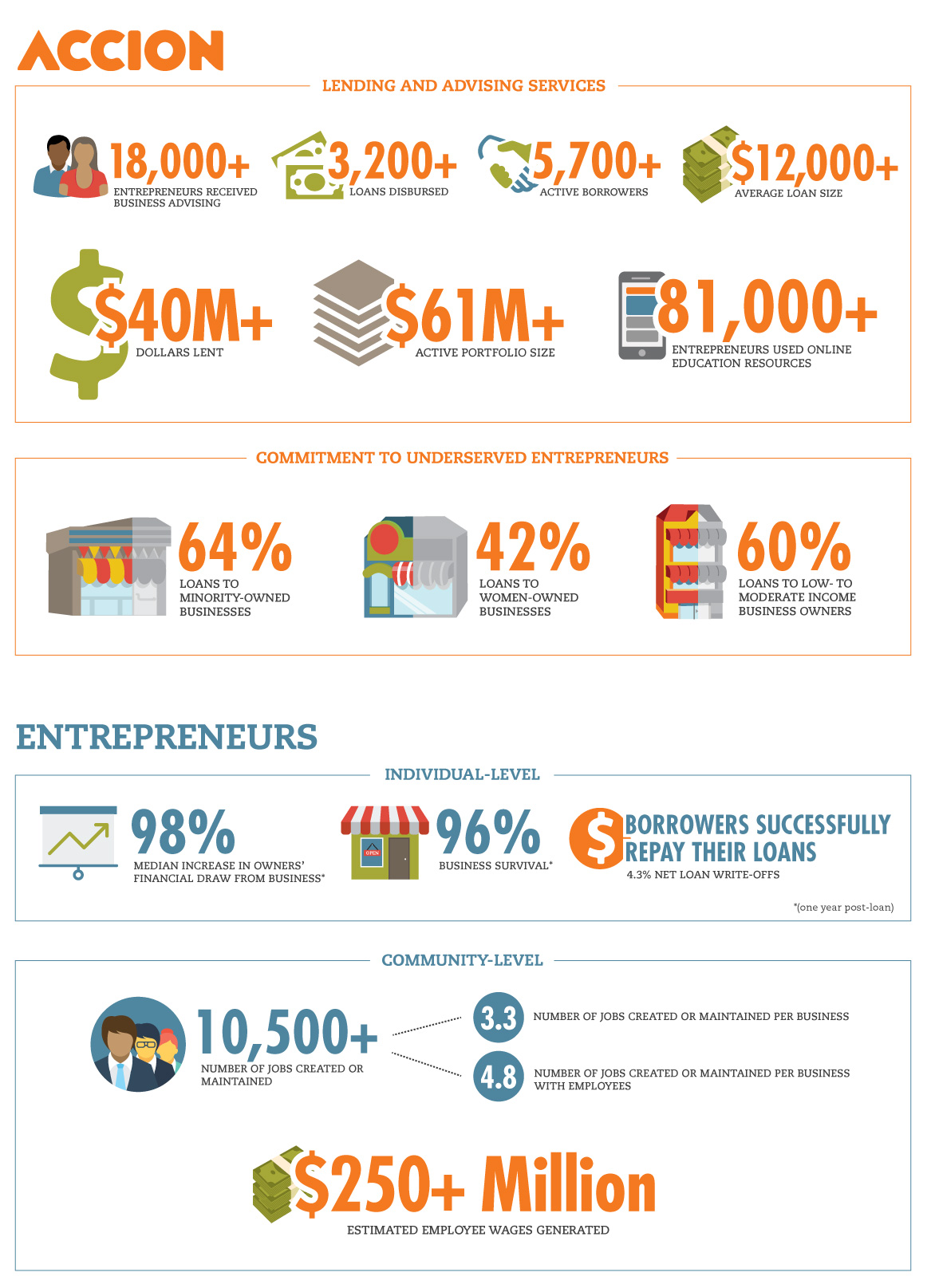

For more than 25 years, Accion's network of four independent community development financial institutions (CDFIs) has been deeply embedded in local small business ecosystems, investing in entrepreneurs who drive local and regional economic growth. Our U.S. Network office, based out of New York, invests in technology, innovation and improved operational efficiency for the benefit of all Accion members. Member organizations served more than 18,000 entrepreneurs in 2016 with loans and business advising, and Accion served tens of thousands more with online business resources. These investments translate to healthy, thriving businesses that created or maintained more than 10,500 jobs in 2016 and generated more than $250 million in estimated employee wages.

For Mariel Cota, owning a business has been a means to get back on her feet and build stability for her family. She and her three children were confronted with the prospect of starting from scratch after she left her abusive ex-husband. She had the skills to start a flower business, but as an immigrant she had limited credit history. "Accion was that key that opened the door for me to start my life again. I was able to get on my feet, to stop being homeless and living in shelters. And now I have my house," she said.

As an entrepreneur and survivor, Mariel is an inspiration to other women in her community who are overcoming major life challenges. Most importantly, she serves as a role model for her children.

"It's so inspiring, for someone to come from basically nothing and have her own business and be able to teach other women that were in her same situation, especially in the span of five years." – Mariel's daughter, Lexi

Mariel's children – Lexi, Derek and Luis – are all exceptional students. And, as children of a business owner, they are more likely than their peers to pursue entrepreneurship someday. "I feel proud," Mariel said. "My kids can see that we can fall and it's okay, as long as we get up."

Alex Castro was inspired to pursue his current career after serving as a probation officer in the Denver juvenile justice system. “I saw that there was a lack of investment in services for the Spanish-speaking community, and that there was a deeper need than just basic psychoeducation classes. There was a need for deeper trauma services, and my clients were not receiving that,” he said. Alex then pursued a master’s degree in community counseling and received a state addiction counselor certification.

While working at a DUI agency, Life Recovery Center, Alex was approached by the owner with an offer to buy the business. "I had already built a rapport with staff, I built a rapport with clients, and so to have an external person come in just didn't seem right," he explained. Alex approached several banks to apply for financing to buy the business, but he didn't meet the requirements because he hadn't been in the business for long enough. Alex isn't alone. In fact, approximately 8,000 small business loan applications are declined each day in the U.S. Fortunately, a member of his PhD cohort told Alex about Accion.

Since taking over Life Recovery Center in 2015, Alex has greatly expanded its service offerings beyond DUI treatment.

"We have to focus on the individual holistically. We're empowering each client to move forward one day at a time, giving them the tools, resources and support they need to reclaim their lives."

When she considers hiring a new team member, Tequila Jarrett understands the value of offering a second chance – including to those who are formerly incarcerated. "Giving those people opportunity, I find that they work so much harder the second time around because they know what they never want to go back to," she explained.

Tequila's family shares in her success. "My family, they're so proud of me even though none of them like to clean," she joked. Tequila named her business – MDW Facility Services – after her son's initials, reflecting her desire to leave a legacy for him. "For him and his kids, and their kids – trying to create some generational wealth around here," she said. That legacy extends to the broader community, as well.

"We are able to help others provide for their families when they otherwise wouldn't have had an opportunity. Success is not always determined by the dollar you have in your pocket. It can be determined by how many lives you've changed."

Tequila's philosophy that "a business can't be successful without its employees" has paid off. Since she founded her business at age 22, it has grown to employ seven team members and earn nearly seven figures in yearly revenue.

Whether it's providing stable and fulfilling employment opportunities or coming to the aid of neighbors in need after a natural disaster, Kris Schoenberger is passionate about making his community a better place. "We wouldn't be where we are without the community," he said. "I love BBQ'd Productions, and I love the staff, and I love my guests that come into the restaurant."

Kris' company participates in numerous charity events in the area, and they are quick to provide assistance to those in need. Two years ago, after a tornado hit their town, the BBQ'd Productions team was on the scene distributing free food and water to affected community members. They fed about 10,000 people over four days.

Kris' business has experienced remarkable growth since he received his first Accion loan in 2013, made possible with support from the Samuel Adams Brewing the American Dream Program. Kris recently opened his third restaurant and employed 65 people over the summer. But for him and his team, growing the company is about so much more than money.

"We'll be able to change a lot of lives. I can't wait to see where things end up because it's been a fun road so far."

– Erin Beake, BBQ'd Productions Employee

"It's scary to let go of a stable job and income to start something completely new, even when you know it's the right path for you." This was the choice facing Lauren Petrick when she decided to leave a professional gymnastics coaching career to pursue her passion of supporting individuals with special needs.

LEAP South Florida is a thriving, fun environment that supports more than 75 special needs athletes and their families. Lauren considers LEAP her second home, adding that the athletes she works with and their families are like an extension of her own family. She describes LEAP as a source of hope "that the stereotypes that have been placed on individuals with special needs can be shattered."

Lauren's accomplishments in advancing special needs athletics aren't limited to the business. She leads the gymnastics program for Special Olympics Miami-Dade County, which now has about 100 participating athletes. Next year, Lauren will be traveling to Seattle for the Special Olympics USA Games as Team Florida's gymnastics head coach with four of her athletes from LEAP. Lauren also started the LEAPlete Foundation, which helps provide families with affordable athletic opportunities as an alternative to the standard therapy, including private classes or group sports programs that incur greater costs.

"The impact that we've made within the special needs community is beyond what I ever thought it would be."

Through the Aspen Institute's EntrepreneurTracker initiative, we know that our services contribute to tangible outcomes for small business owners one year after they receive a loan – including a 96% business survival rate, a 98% median increase in take-home pay and three jobs created or sustained on average per business. However, we have been limited in our study of the holistic, longer-term impacts of small business lending and business advising – particularly those impacts that go beyond traditional quantitative measures. That's why in 2015 Accion and fellow mission-based lender Opportunity Fund launched a first-of-its-kind, multi-year evaluation effort in partnership with Harder + Company Community Research. This work is made possible through generous lead funding from the W.K. Kellogg Foundation and JPMorgan Chase & Co., with additional support from S&P Global.

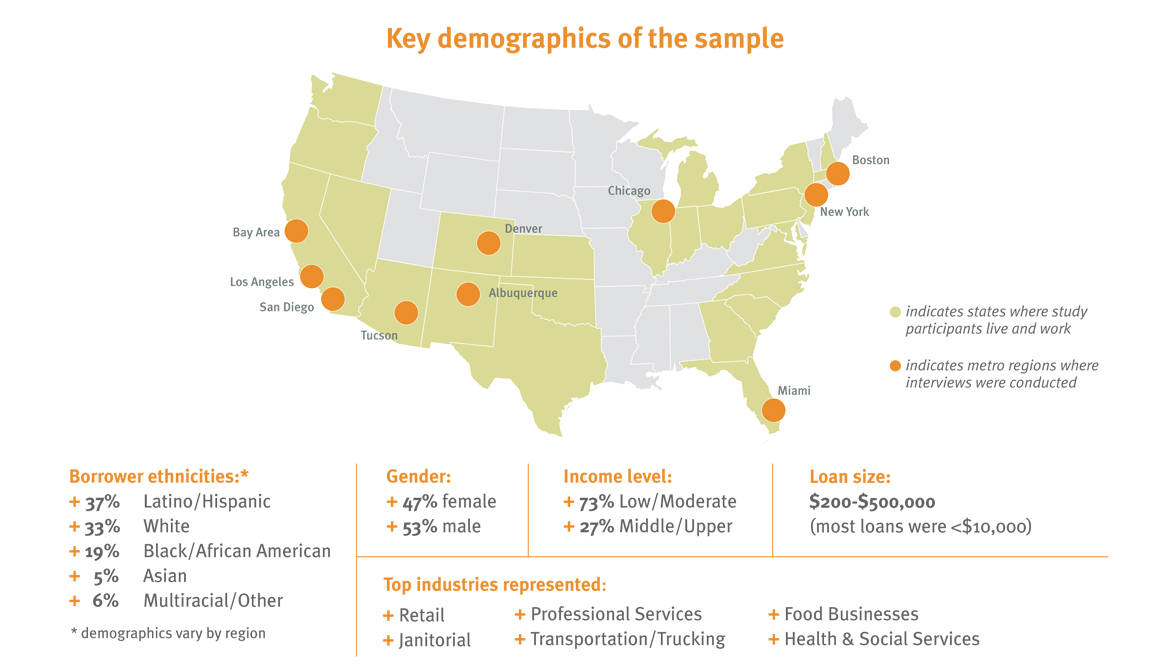

In the first phase of data collection, conducted between January and June 2016, we surveyed 571 small business loan borrowers across 27 states, and completed in-depth interviews with 188 of these individuals from 10 metropolitan areas. We are pleased that the participants in this research reflect the broad geographic, demographic and occupational diversity of business owners served through the mission-based small business lending industry.

Preliminary findings from this research indicate that lending and advising services have clear benefits to our clients. The majority of participants said they had increased business sales (62%) and profit (55%) in the previous six months, and most said that their loans had a significant impact on these growth indicators. Nearly half of those who had hired new employees (representing approximately a third of employer businesses) said that their loan had a significant impact on their ability to do so. Entrepreneurs also had positive outlooks on the future: most projected increases in business sales (83%), business profit (81%), take-home pay (71%) and household savings (69%) over the next six months.

When asked to rate the impact of their loan on various aspects of their lives, business owners said that their loan has made the most impact on their confidence to achieve their goals and on their ability to improve their credit. Many spoke of the discouraging effect of loan denials from traditional financial institutions, noting that an approval from Accion or Opportunity Fund helped them persevere. As one Chicago entrepreneur said, "Accion gave me hope to keep my dreams and goals alive and to continue on creating and giving back."

Findings also suggest that entrepreneurs have diverse visions for the future of their businesses. For many entrepreneurs participating in the study, the desire for financial stability outweighed interests in business growth. Family plays a significant role in business owners' personal goals, with the vast majority of participants agreeing that having more money to support their family (91%) and having more time to spend with family (85%) were important factors in starting their businesses. Most business owners (59%) said their loan helped them greatly in achieving their personal goals.

Through these preliminary findings, we know that services provided by mission-based lenders like Accion help small business owners gain the financial stability and confidence they need to achieve their goals. The findings also raise new questions about how to best support entrepreneurs in building financial stability and resilience. As early as a year after receiving their loan, many small business loan clients continue to cite finances as a key source of worry – despite increases in their revenue and improvements in their financial management practices. Additionally, most business owners in the study said they are not prepared for a financial emergency. "It's a huge concern as a business owner, that something could just happen one day and it could really, really damage us as a young business," said one Los Angeles entrepreneur.

In 2017 we will examine the longer-term impact of small business lending through additional interviews and borrower surveys. We will also explore new questions that were raised in the initial phase of research, including the challenges small business owners face in preparing for financial emergencies. In the meantime, we have already begun to explore solutions to the challenges raised through this evaluation work. For example, Accion is working with the Center for Financial Services Innovation (CFSI) to better understand the barriers business owners face to adopting financial behaviors such as saving and business planning. Insights from this work will allow us to prototype, test and refine scalable solutions to help entrepreneurs build long-term financial stability.

We look forward to the further insights that will emerge from the next phase of this research and hope that the findings will continue to encourage productive dialogue and exploration among our peers and those who are invested in our work.