Focused and growing

44% of participants

- Started strong and staying strong

- Growth-oriented

- Business is the sole source of income

- Building financial stability

- Job creators

A longitudinal study on the impact of mission-based lending services on small business in the United States

Full ReportThe study’s findings reinforce the urgency to bring mission-based lending to scale, thereby providing this critical service to all entrepreneurs who stand to benefit.

As mission-based lenders, Accion and Opportunity Fund work with entrepreneurs who are locked out of traditional financial systems to increase their access to capital, networks, and education that will help them reach their business goals. Though many studies have measured the outcomes of mission-based lending, Harder+Company’s longitudinal study of Accion and Opportunity Fund clients is the first of its kind because it measures impacts on entrepreneurs’ experiences as business owners.

“Ever since we got that loan … we started to have cash flow. So, we grew economically and personally and the business settled down more.”

“As a result of the loan, I was able to buy more inventory, which in turn gave me more revenue from different revenue streams, which then meant my cash flow was healthier, which then allowed me to bring on employees. It’s a trickling effect.”

“Once we got in the new staff, that opened up the whole possibility to us of adding more services into the facility.”

“The biggest thing has been the confidence that I’ve gained in myself…I’m really proud of it.”

Harder+Company surveyed over 500 borrowers, 188 of whom were also interviewed, in 2016. Follow-ups were conducted in 2017 for 350 surveys and 100 interviews.

Choosing entrepreneurship is brave, and it’s not always easy. The challenges Harder+Company illuminated with this study light a path forward for Accion and Opportunity Fund to focus on serving clients in specialized ways that focus on these specific areas.

“I have seasons where I can earn two, three times what I would make in a weekly paycheck. And then there are weeks when I don’t make much.”

Turning Insights into Action

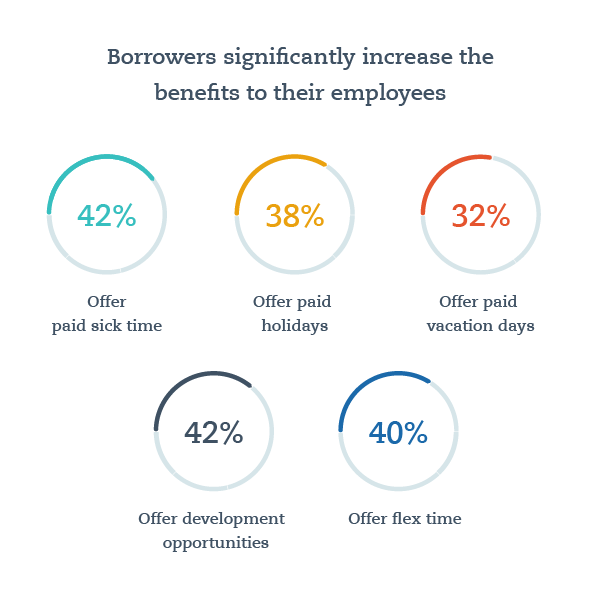

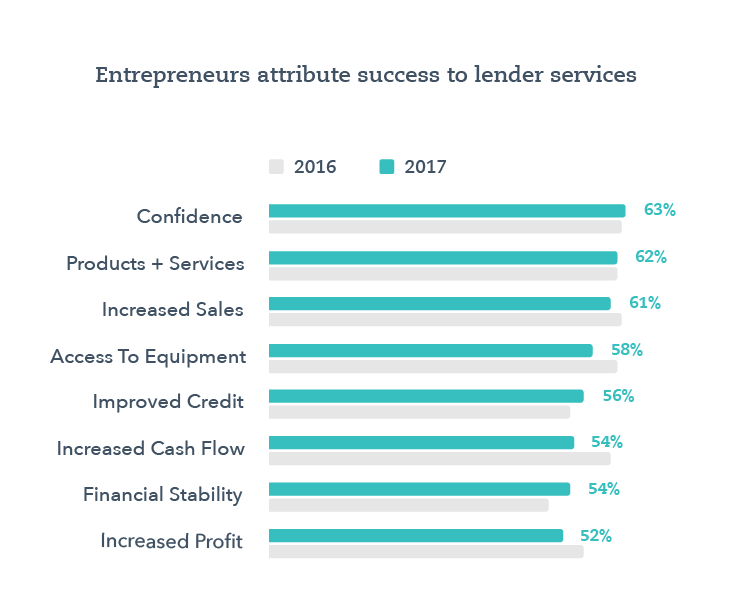

Equipped with a deeper understanding of client’s successes and challenges, Accion and Opportunity Fund are in a position to help their entrepreneurs write their own success stories. Harder+Company’s research revealed that entrepreneurs are thriving in the face of obstacles, and they attribute many measures of their progress to their experiences with mission-based lenders.

Armed with new impact data and findings that support efforts to meet entrepreneurs’ unique needs, Accion and Opportunity Fund will continue to serve small business owners, adapting products and services to better fit clients’ current experiences.

Harder + Company’s research revealed that entrepreneurs are thriving.