GINA HARMAN

Chief Executive Officer

U.S. Network, Accion

ANNA DODSON

Board Chair

U.S. Network, Accion

As the familiar adage goes, “If you want to go fast, go alone. If you want to go far, go together.”

With more than 25 years of experience and more than 67,000 loans disbursed, Accion in the U.S. has a strong track record of providing enterprising small business owners with the capital and business support they need to fuel their success. However, the opportunity that remains is far greater, as the gap in access to affordable capital continues to loom large. As we seek to scale our work in the U.S., we know that a key opportunity for growth is through partnerships, which allow us to reach new audiences through new channels and provide greater value to entrepreneurs in ways that would not be possible on our own.

Accion has long been an active partner in the small business support ecosystem, alongside other mission-based lenders, government agencies, and community organizations across the country. This year, we celebrate growing partnerships that are adding new dimensions to Accion’s work as we seek to innovate and address the evolving challenges facing entrepreneurs. This annual report highlights just a few of the ways we are collaborating at a national level for greater reach and impact, including:

The value of working together to support entrepreneurs is demonstrated in the impact these partnerships have on the entrepreneurs themselves. Heather Yunger of Top Shelf Cookies in Boston credits advisors from longtime Accion supporter Samuel Adams with providing critical advice as she was growing her business. Michael White of Michael’s Handcrafted Luxuries in Chicago combined an Accion loan with an entrepreneurial training program from a local partner to build his credit score from zero to nearly 700. Lee Francis of Red Planet Books and Comics in Albuquerque credits his success to numerous organizations and individuals that supported him along the way, and he is passionate about paying it forward by supporting local entrepreneurs and Native youth. Jennifer and Kevin Long, owners of San Diego-based online children’s marketplace Noble Carriage, worked with a financial counselor identify ways to reduce their monthly expenses by $650 and invest those savings into their business. It is through the inspiring stories and success of these entrepreneurs that we achieve impact together.

We are grateful to our funders, so many of whom walk hand-in-hand with us in seeking to build up the entrepreneurial support ecosystem, asking the critical questions, thinking through challenges together, and trying new approaches when something is not working. In addition to financial support, having access to the wealth of insights and expertise they bring to our work is invaluable.

To our friends, our partners, and our supporters, we thank you for joining us on this journey. Here is to another year of going far together.

Sincerely,

GINA HARMAN

CEO

U.S. Network, Accion

ANNA DODSON

Board Chair

U.S. Network, Accion

Through our decades of experience lending to underserved entrepreneurs, Accion in the U.S. has long had access to rich data about small business owner needs, challenges, and opportunities. Until recently, however, we lacked the tools or in-house expertise to analyze this data and apply it, identifying opportunities to serve our clients better. In 2018, we were pleased to add strong data analytics capacity to help us strengthen our ability to be a data-driven organization. Using that newly established capacity, we partnered with the Financial Health Network (formerly the Center for Financial Services Innovation) to develop a framework to measure the financial health of small business owners. We were part of a small group of financial services providers who surveyed our clients about several aspects of their financial health to inform the development of a Guide to Measuring Small Business Financial Health, which can strengthen our work and the work of others in our field. As a mission-based organization, we want to make sure that the products and services business owners use are improving their lives, which is why we are invested in measuring financial health as part of understanding the impact of our work.

A recent evaluation study revealed that despite significant gains in financial stability and business growth, many of our clients continue to report feelings of anxiety related to their finances in the years following their loan. To address this challenge, we were excited to launch a pilot partnership with Neighborhood Trust Financial Partners, a provider of financial empowerment services and products, to offer personal financial counseling to nearly 150 Accion clients. Their Trusted Advisor program provides access to a personal financial counselor through a customized online portal with video call or phone sessions. The counselor and client work together to develop a financial action plan, and the client receives SMS and email reminders to stay on track in following their financial action plan. The client has unlimited access to sessions with the counselors, who are trained to focus on helping people balance and take control of both business and personal finances. Accion clients who participated in the counseling made impressive gains: more than half improved their credit scores, reduced their total debt, and/or reduced their collections balances. Participants reported taking a variety of concrete actions as a result of the counseling, including paying down credit card balances and setting up an emergency fund. The vast majority felt they had a more solid financial plan for their business after counseling and that the service helped them meet at least one business or personal financial goal. We look forward to building upon this successful pilot partnership with Neighborhood Trust to continue to offer these supportive services to our clients in 2019 and beyond.

In the U.S., consumer protections for financial products don’t apply to business financing, and entrepreneurs of color are disproportionately impacted by this regulatory gap. According to the Federal Reserve, Black and Latinx business borrowers are twice as likely as their white peers to utilize high-cost products like Merchant Cash Advances (MCAs), which often charge triple-digit annualized percentage rates that they fail to disclose to borrowers. As a mission-based lender that primarily serves entrepreneurs of color and that has seen a rise in business owners seeking relief from harmful products, it is critical for Accion in the U.S. to play a leadership role in solving this problem. That’s why we co-founded of the Responsible Business Lending Coalition in 2015, a cross-sector collaboration of non-profit and for-profit lenders, investors and small business advocates that created the Small Business Borrowers’ Bill of Rights. In 2018, the Coalition’s advocacy contributed to important milestones for responsible business lending practices, including the passage of the nation’s first small business truth-in-lending law in California.

“What kind of insurance do I need for my business? How do I write a business plan? What small business tax deductions can I take?” Entrepreneurs who come to Accion have many questions that go beyond financing, which is why we created a library of digital content – articles, webinars, infographics, and more – that can help entrepreneurs navigate challenges on a variety of topics related to starting or growing their business. In 2018, we saw a doubling of traffic to our digital library, reaching nearly 300,000 unique visitors. We also achieved a more than 50% increase in the number of people who signed up for our business resource e-newsletter, which has more than 27,000 subscribers. We continue to look for ways to improve our digital experience to make it easy for entrepreneurs to access the tools and resources they need to succeed.

We are grateful for the partners and supporters of our work who have joined us in sharing insights and best practices to benefit the broader small business ecosystem. We participated in a podcast on NextBillion Financial Health, supported by the MetLife Foundation, to engage in a candid conversation about why mission-based small business lenders can’t afford not to adopt new technologies, and the challenges that they might expect to confront in the process. We joined Grameen America and the Mastercard Center for Inclusive Growth in articulating the value of nonprofit/private partnerships in accelerating access to capital for women entrepreneurs. Throughout the year, we shared insights from our longitudinal study exploring the impact of mission-based small business lending in partnership with diverse thought leaders as well as our study collaborators – fellow lender, Opportunity Fund, research partner, Harder+Company, and lead funders, W.K. Kellogg Foundation and the JPMorgan Chase Foundation. From webinars, to industry conferences, to collaborative thought pieces, we shared how the findings offered an unprecedented understanding of the financial lives of underserved entrepreneurs. Through these engagements and more, we participated in valuable conversations with diverse industry leaders that continue to fuel innovation and collaboration to advance our shared mission.

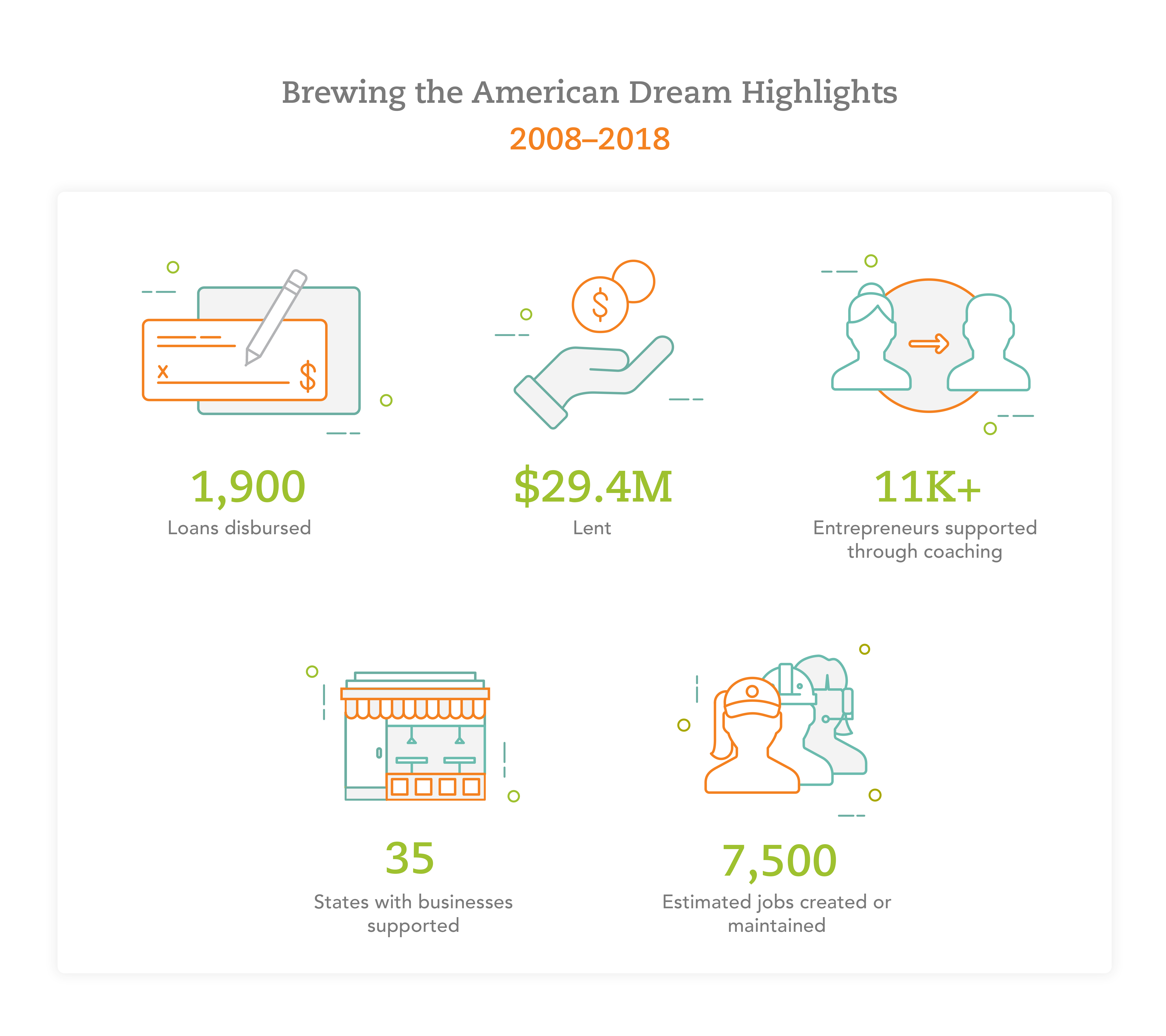

In 2018, Accion was thrilled to celebrate 10 years of partnership with the Samuel Adams Brewing the American Dream program, which supports small food and beverage businesses across the country with access to capital, coaching and networks to help them thrive. Together with Samuel Adams, we organize speed coaching events, business pitch competitions, webinars, and one-on-one mentoring with Samuel Adams employees to reach hundreds of entrepreneurs a year with the key ingredients to start or grow a successful food or beverage business. We are grateful for the company’s longtime commitment to our mission, which stems from Founder and Brewer Jim Koch’s passion for craft and understanding of what it takes for an entrepreneur to succeed based on his own entrepreneurial journey starting the Boston Beer Company nearly 35 years ago.

Heather Yunger

Top Shelf Cookies

Boston, MA

Heather Yunger’s passion for baking and Boston converged during the 2011 hockey season, when she started bringing “Black & Gold” cookies made of dark chocolate and peanut butter chips to her local bar in support of the Boston Bruins. This game day superstition resulted in a Stanley Cup win for the Bruins and an avid fan base for Heather’s cookies. Her fellow bar patrons encouraged her to pursue her passion as a career – particularly Jennifer Glanville, Brewer and Director of Partnerships for Samuel Adams, who told Heather about the Samuel Adams Brewing the American Dream Program, a partnership with Accion that supports small food and beverage businesses with access to capital, coaching and networks. In addition to a loan, the program offered Heather access to mentoring from Samuel Adams staff on many topics, including social media, marketing, and public relations. Heather started with $2,500 and a dream, and with support from Accion, Samuel Adams and other community partners she has expanded Top Shelf Cookies from catering special events to selling her products wholesale and preparing to open a storefront. Regardless of what the future holds for her business, Heather knows one thing for sure. “I love my job!”

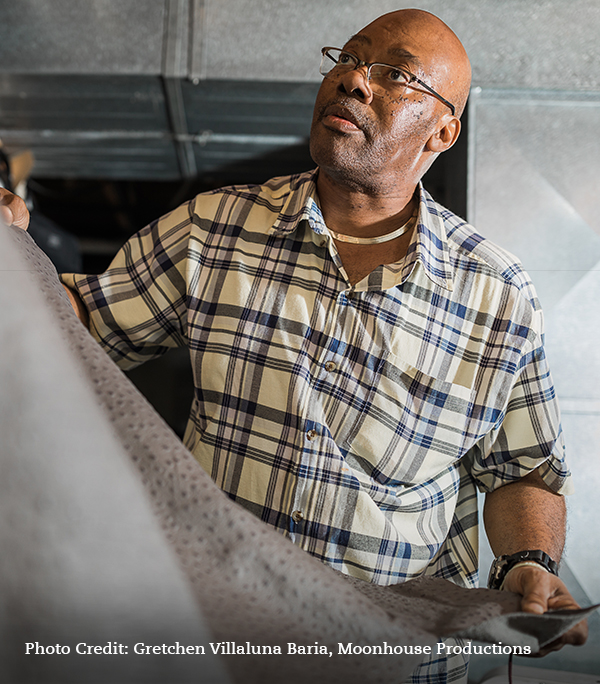

Michael White

Michael’s Handcrafted Luxuries

Crete, IL

For Michael White, working with leather is more than an occupation. The entrepreneur credits his craft for helping him survive nearly two decades of incarceration. “It takes you away from the negative parts of being in prison. You take that same calmness back with you and you try to relay that to other people that you're around.” Michael’s transition after being released from prison was daunting on multiple levels, from adapting to a reality where smartphones are the norm to navigating the mainstream financial system with a limited credit history. An entrepreneurship training program offered through the Safer Foundation and sponsored by Chicago Neighborhood Initiatives, both long-time partners to Accion in Chicago, helped Michael learn critical aspects of growing a business. A loan from Accion helped him purchase new sewing machines and build his credit score from zero to nearly 700. Michael is dedicated to continuing to build his business and his financial security, and he wants to provide opportunities for his community by hiring employees who have overcome challenges like him. “A lot of us who are returning are knowledgeable about things; we want to use our skills and help the community.”

Lee Francis

Red Planet Books and Comics

Albuquerque, NM

As an educator, Lee Francis grew frustrated by the lack of reading materials whose protagonists his students could identify with. “They didn’t get to be super heroes in their own stories.” That recognition drove Lee to marry the storytelling skills he honed through his background in theater with his lifelong love of comics to launch Native Realities, a publishing company dedicated to Native-centric media, and Indigenous Comic Con, a festival celebrating leaders across Native pop culture. The success of these ventures led Lee to open a retail storefront, Red Planet Books and Comics, with support from an Accion loan. In addition to providing guidance on business management and growth, Accion has supported Indigenous Comic Con as a sponsor. “Accion is not just a lending organization. It’s part of that ecological support system,” Lee said. Lee credits his success to numerous organizations and individuals that supported him along the way, and he is passionate about paying it forward by supporting local entrepreneurs and Native youth. “I need to open as many doors as I possibly can, so that my son and Native kids have as many opportunities as the western kids that will make them content, happy and healthy in this world.”

Jennifer Long & Kevin Long

Noble Carriage

San Diego, CA

As Jennifer Long learned about the health and environmental impacts of the fashion industry, she became fixated on a vision of how she could make a difference through baby clothing. “When I was pregnant, I found it super overwhelming to find products that are actually safe to put on my baby's skin, and also good for the planet,” she recalled. In 2014, Jennifer launched Noble Carriage, a marketplace that curated the best organic and sustainably produced baby clothing, with her husband and business partner, Kevin Long. Noble Carriage has built a loyal customer base by making sustainable living approachable for busy parents. With support from an Accion loan, the business recently began manufacturing its own line of baby clothing. Jennifer and Kevin also took advantage of free financial coaching though Accion’s partnership with Neighborhood Trust, which has helped them identify ways to reduce their monthly expenses by $650 and invest those savings into their business. As the company grows, so, too do their most important customers. As Jennifer put it, “The babies who wear our clothing will grow up and hopefully be the ones who can make actual changes to the policies that will change the fashion industry for the better.”