AOF and NMSDC

We structure loans that work for your business, not someone else’s

We offer loans¹ for small businesses from $5k to $250k as well as educational resources, coaching, and support networks in English and Spanish

We lend differently

Mission Driven

Because we don’t exist to make profit, we use the money from your repayment to support other business owners.

Customized loans and repayment terms

No two businesses are alike, so we structure loans that work for your business, not someone else’s.

We speak your language

We offer 1:1 coaching in English and Spanish to support you when you most need it.

Lorem ipsum dolor sit amet, consectectur adipiscing elit.

Business record keeping is essential for a variety of reasons, each contributing to the smooth operation and long-term success of a business. Here are the key reasons why it is important:

On average, AOF’s lending in these five states generates $2.05 in additional annual economic activity within each state’s economy—meaning that for every dollar we invest in a small business, more than $2 is spurred annually in the form of new taxes, new spending, and new wages in these states.

This is a Ribbon Style Content block

How to Apply

It’s wonderful that groups like Accion Opportunity Fund think about small businesses and ways to help us survive…And I think that’s what makes pandemics like this survivable, is that you know that there are people who are out there who care.

Dora Herrera

Yuca’s Restaurants

Accion Opportunity Fund vio mi potencial y estuvo allí para soñar conmigo y hacer mi sueño realidad.

Alicia Villanueva

Owner of Alicia’s Tamales Los Mayas

It was nice to have somebody interested in my business, who cared about and wanted to work with us.

Jimmy Orozco

Iguanas Burritozilla

The loan process was very easy and straightforward. I was pre-approved for an amount, provided the documents needed, the loan was approved the next day, and I received the funds shortly after.

Kelli

Owner of Breedlove Beauty Co.

They got back to me the very next day and said I got funded. I cried, because it felt like someone believed in me.

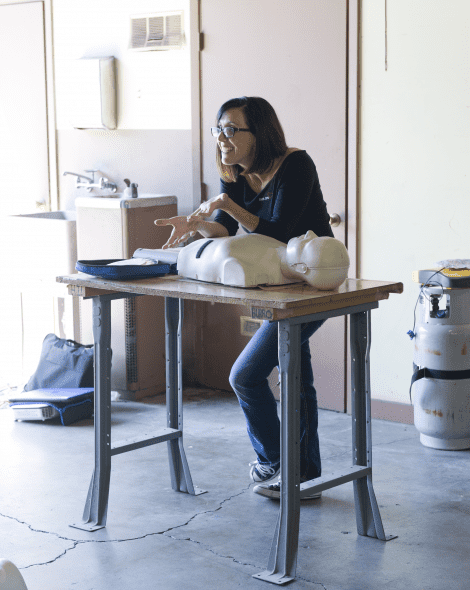

Shannen Enos

Enos CPR

Threads was able to secure funding from AOF when conventional banks were not an option, and it made a HUGE difference for us!

Kara Valentine

Co-founder of Threads Worldwide

Accion Opportunity Fund has more options and more flexibility than most loan companies.

Barbara Sullivan

Sullivan International

I never knew how difficult it might be to get funding. If someone knew about Opportunity Fund and could start with you, they would not have gone through what I did. I?did not?feel pushed aside.

Sean Afkhaminia

Footy Factory

The restaurant industry is very tough and I’m glad Accion Opportunity Fund is there for me.

Cynthia Vo

Phonomenal and Flipside

Ways to use your loan:

- Expand your business

- Hire employees

- Stabilize Cashflow

- Cover payroll

- Relocation

- Buy Equipment

- Purchase inventory

- Buy supplies

- Marketing

- Building improvements

FAQ

Business record keeping is essential for a variety of reasons, each contributing to the smooth operation and long-term success of a business. Here are the key reasons why it is important:

On average, AOF’s lending in these five states generates $2.05 in additional annual economic activity within each state’s economy—meaning that for every dollar we invest in a small business, more than $2 is spurred annually in the form of new taxes, new spending, and new wages in these states.