What is Predatory Lending?

Does your lender have your best interest at heart? Learn the 7 signs to help you identify predatory lending and how to protect your business.

Unfortunately, small business owners are common targets for predatory lending. It can be difficult for small businesses to get loans, especially startups with no track record of success. The reality is when unable to qualify for a loan from a mainstream bank, you’re left with fewer options. Some of the places you might be tempted to turn for a loan might practice predatory lending, which is harmful to your growing business.

Most of your borrowing experience to date has probably been with major commercial banks or credit unions for mortgage loans, or with financing companies for car loans. These transactions are highly regulated with laws that cover the way they’re handled, and protections built-in for both borrowers and lenders. Don’t expect the same when it comes to small business lending. You may actually even be shocked by how some companies do business in this far-less-regulated area.

One of the oldest bits of advice is still one of the best: if it sounds too good to be true, it probably is. It’s also one of the most important things to keep in mind when it comes to making a decision about what kind of funding to get for your business and where to get it so that you don’t fall prey to predatory lending practices.

What is Predatory Lending?

There is no single legal definition for predatory lending, but the FDIC’s Office of Inspector General has called it “the imposing of unfair and abusive loan terms on borrowers.” There are two ways this happens. First, the language of the terms of the loan may sound reasonable but actually, be anything but. Second, you understand the terms aren’t favorable but feel you don’t have any other options. Either scenario is a potential recipe for trouble, so let’s explore what to watch out for.

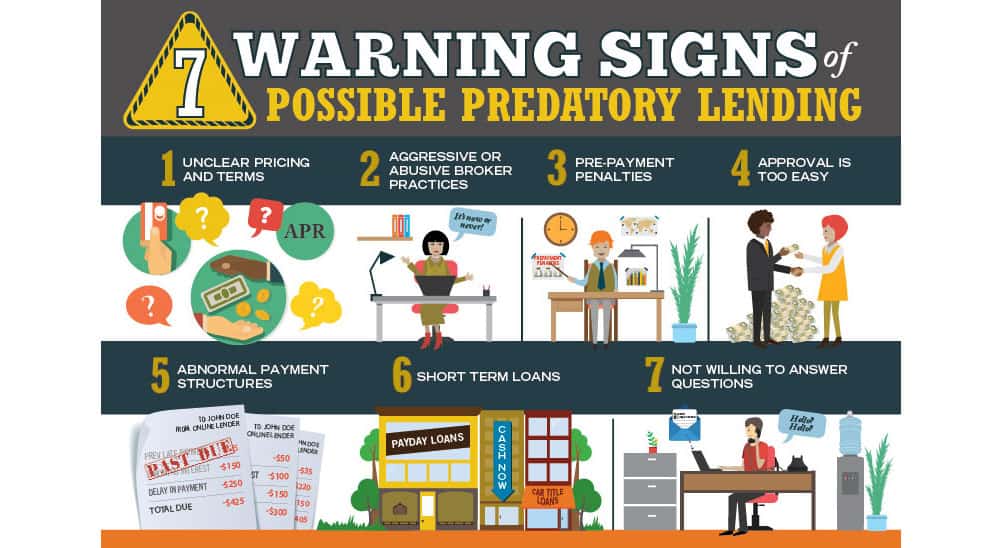

7 Warning Signs Of Possible Predatory Lending

Some lenders will use deceptive, sometimes even fraudulent practices to try to attract you. If you’re not careful, you could wind up with terms that are very unfair to you, ones that could possibly cripple your business.

On their own, some of the warning signs may not be enough to steer you away from a specific loan or lender (although some truly do raise red flags), but when you start to see two or more, be on your guard for sure. This deal is probably not in your best interest.

So how do you know if a lender is reputable and above-board? The following warning signs may indicate predatory lending practices.

1. Unclear Pricing And Terms

Red Flag: Lack of transparency, fees/interest rates not listed as APR or listed in a format that is hard to calculate.

In an ideal world, each and every lender would be upfront about the fees, risks, and terms of the loan. Shady lenders may use unusual terms or formats to keep you from getting a clear sense of what’s going on. They may also try to rush you into accepting the loan before you’ve had time to review and clarify everything.

If all of the terms of the loan aren’t clear to you, don’t sign. You’ll need to know what fees to expect, what interest rate you’ll be charged, whether there will be any balloon payments or penalties for early repayment, what the repayment terms are, and what happens if you make a late payment. Your lender should be able to answer all of those questions clearly and completely.

2. Aggressive Or Abusive Broker Practices

Red Flag: Brokers who don’t disclose extra interest or fees or push you into accepting a loan you’re not fully comfortable with.

Find out whether you’re paying a kickback to the broker. Brokers can inflate the interest rate on your loan and call it a “yield spread premium” to cover their fees. That means you’re paying more than you have to. Your broker should be upfront and honest about his or her fees.

3. Pre-Payment Penalties

Red Flag: Penalties for paying the loan off early, fees for extra items like insurance.

Lenders make money when they charge interest on your loan. That means each party has competing goals: your incentive is to pay off the loan early to save money and their incentive is to discourage early pay off or refinancing so you pay as much interest as possible.

A small fee for prepaying the loan is typical, but you should be wary of any lender who demands a big fee. You should also be cautious about a lender who agrees to an early payoff in exchange for an even larger loan – they use that tactic to keep you trapped in a revolving door of debt.

4. Approval Is Too Easy

Red Flag: Offers fast and easy approval with little or no required documentation.

Reputable lenders require documentation, including detailed information about business plans and existing finances, before offering financing. Even microlenders, who specialize in small business loans and are usually more flexible than traditional banks, still have a thorough application process.

If a lender approves you for a loan without performing proper due diligence, it may be a sign that you’re not working with a scrupulous organization. It’s tempting to take a loan that doesn’t require all that groundwork, but it indicates that the lender isn’t concerned with the actual viability of your business plan. That means they’re planning on making their money whether you’re successful or not – usually through high rates and fees.

5. Abnormal Payment Structures

Red Flag: Payments debited daily, weekly, or as a percentage of sales.

Don’t agree to payment terms that vary from day to day or month to month. Payment should be consistent across- the board and that schedule should be documented. You need to know how much you owe and how much you’ll be paying every month or every few weeks – you don’t want to be stuck in a situation where you never know when they’ll pull money out of your account.

6. Short Term Loans

Red Flag: Loans that must be repaid in a very short time.

Short-term loans may also be called “Payday Loans” or “Car Title Loans.” “Tax Refund Anticipation Loans” are a similar form of short-term cash advance with an exceptionally high APR. These short-term loans allow borrowing against your employer-issued paycheck, your vehicle title, or your pending tax refund. They often have extraordinarily high-interest rates and severe penalties for nonpayment. These lenders are betting that you won’t be able to pay them back on time, so you’ll get stuck racking up interest charges and fees.

In many cases, these “alternative lenders” fall outside the regulations that apply to traditional banks, meaning you don’t have the legal protection you would when dealing with a reputable institution. However, they may offer funding in the form of traditional business loans or lines of credit, which can be deceiving unless you’re looking closely at the terms and conditions.

7. Not Willing To Answer Questions

Red Flag: Hard to contact, dodge questions about cost and terms.

Reputable bankers want to work with you to help you achieve your goals. They want to understand your business and work with you to achieve financing that will boost the future of your business, not burden it. They want you to understand what you’re signing up for – they want you to actually be able to repay the loan. If the lender won’t respond to your questions, they may have something to hide.

Predatory Loan Types

In general, you’ll be safe from most predatory lending practices when you borrow from a reputable bank, credit union, or microlender. Areas where there may be regulatory gaps include many forms of short term loans such as Payday Loans or Car Title Loans, where you borrow against a paycheck or the title for your car.

Payday Loans and Car Title Loans typically carry extremely high annual percentage rates and can trap borrowers in a cycle of debt. Tax Refund Anticipation Loans are a similar form of short-term cash advance with an exceptionally high APR.

So-called “alternative lenders” can also be problematic, as many fall outside the regulations that apply to traditional banks. Funds from these lenders can range from true business loans to cash advances, lines of credit, and personal loans. Your payments will include interest and fees, and unless you look closely, you may not realize the APR can easily top 50%.

How to Protect Yourself

By reading this article, you’ve already taken the first step, which is to educate yourself about what predatory lending is and how to spot it. Other, concrete steps you can take include:

Take your initial request for funding to a traditional bank or local credit union.

If you’re turned down, ask about reputable financing options. microlenders like Accion Opportunity Fund specialize in small business loans are usually more flexible, and may approve you when a traditional bank won’t.

Talk to trusted financial professionals.

Many small business owners are so enthusiastic to start and grow their businesses, they may not be aware of all the resources available to them. This enthusiasm can lead to making quick decisions that don’t always turn out to be in the best interest of the business, and predatory lenders know this and prey on it. Accion Opportunity Fund recommends working closely with an accountant or bookkeeper. Make sure your financials are current and you’re keeping them updated. This allows you to anticipate cash flow needs before they become urgent.

Beware of unsolicited offers.

Offers of loans through the mail, over the phone, or door-to-door solicitations are suspect, and reputable lenders typically don’t operate in this way.

Avoid overpromises.

Steer clear of lenders who promise you loan approval regardless of your credit rating or credit history. Talk with a banker, even if you might not be approved by a traditional bank, to gain an understanding of what you should be able to qualify for and realistically pay back.

Don’t rush.

It’s tempting to take the first offer that comes along, especially if your business needs immediate financing to grow, or worse, stay afloat. But don’t let yourself be hurried into signing paperwork you don’t fully understand or with terms you shouldn’t agree to.

Faster is not always better. You want a lender to take your current financial and personal situation into consideration to ensure that the loan is what’s best for you. That takes time. Think long term. How is this going to affect your cash flow and profit? Can you afford the payments?

Understand the interest rates and fees.

Ask for a breakdown in writing so you know exactly what you’re paying for and how much you’re agreeing to. Insist on seeing all the fees and charges ahead of time, including any prepayment penalties. If they won’t tell you, don’t take the money.

Often you will owe interest on the advance regardless of whether you pay it early. Don’t be afraid to question rates that seem out of proportion. And most importantly, do NOT agree to a loan with terms or payments that you can’t afford.

Learn about the difference between interest rate and APR.

Decline additional services.

You don’t want or need additional credit, health, or disability insurance (and if you do, you will almost certainly find them available elsewhere for less.)

Watch out for prepayment penalties.

Prepayment, if you can manage it, may not be in the lender’s best interest, but it is in yours. Don’t accept a loan that penalizes you for being able to pay it off early.

Read reviews and research.

See what past customers have to say about the lender. Also, see if the lender has signed the Borrowers’ Bill of Rights.

The Women’s Capital Directory is a great place for all entrepreneurs to learn about CDFI lending options. The directory is searchable by location, time in business, and lending amount, among other filters.

Use your best judgment.

Sadly, when you’re feeling desperate, it’s easy for good judgment to go out the window. Predatory lenders make victims of vulnerable individuals every day just because a short-term need has overtaken a lifetime of common sense. If your gut is telling you a deal may not be kosher, listen.

The danger is real and companies have been forced to close because they didn’t have the cash available to pay off their loans. At best, it becomes a vicious cycle, with businesses taking out additional loans or merchant cash advances as they try to keep up with payments. Most business owners hope the funds would be available and they would never have to use these products again.

Don’t sign any documents that contain blank spaces. Don’t agree to payment terms that may vary from day to day or month to month. Read every piece of paper carefully, and have a trusted friend (or better yet, your attorney or accountant) read them as well.