A Longitudinal Impact Study of Accion and Opportunity Fund Small Business Lending in the US

The Longitudinal Impact Study of Accion and Opportunity Fund Small Business Lending in the U.S. is a first-of-its-kind national, longitudinal, qualitative examination of these outcomes. It reports on a nationwide cohort of 350 Accion and Opportunity Fund borrowers who were followed for as long as three years post loan in order to understand the impact of small business lending services on their businesses, their personal financial security, and their overall quality of life. The study examined how business owners define success and how access to capital supports their goals. Findings from this study not only identify opportunities for lenders to better meet the needs of entrepreneurs, they also provide evidence to other lenders, policymakers, and small business supports about the ability of micro- and small-business lending to transform lives.

Key Findings

Entrepreneurs continue to see the positive impact of Accion and Opportunity Fund capital years after receiving a loan. Regardless of their loan size (the majority of loans were under $10,000), most entrepreneurs are thriving and continue to attribute a positive impact on their business and their personal lives to Accion and Opportunity Fund. Business owners said their loan helped them meet personal goals such as improved credit and an increased sense of legitimacy as “real businesses,” as well as increasing their confidence to achieve their goals. Accion and Opportunity Fund capital also helped business owners acquire new equipment, expand or modify products and services, increase sales, and improve cash flow. And, most report greater control of their time and a more favorable work-life balance because of their loan.

Accion and Opportunity Fund met the needs of these business owners at just the right time—many of them had tried other lenders to no avail. Business owners continue to see the effects of their loan several years after the capital was spent.

Access to capital fueled business growth. Loans, business advice, and networking opportunities made businesses stronger. More than half of the business owners in this study saw increased profits, nearly 40% added employees, and many of those with workers increased employee benefits. In fact, the 350 business owners in this study added a total of 334.75 Full Time Equivalents (FTEs) between 2016 and 2017.

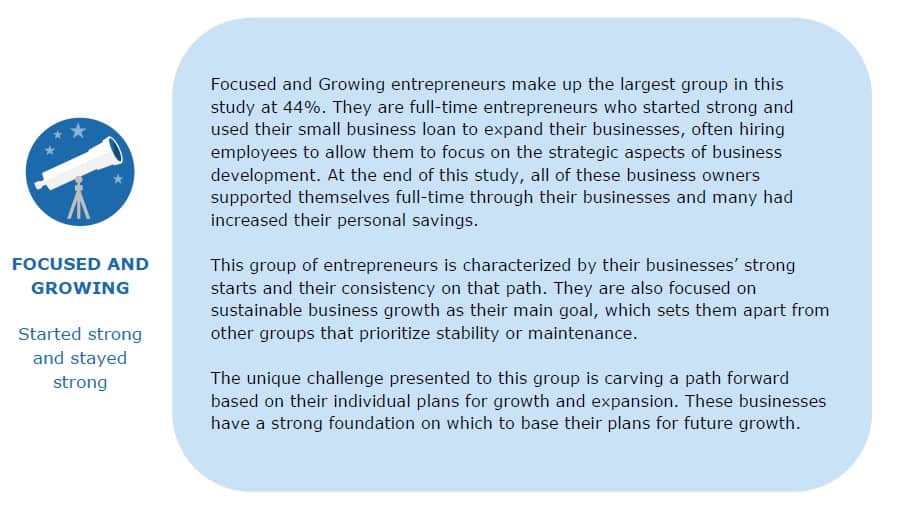

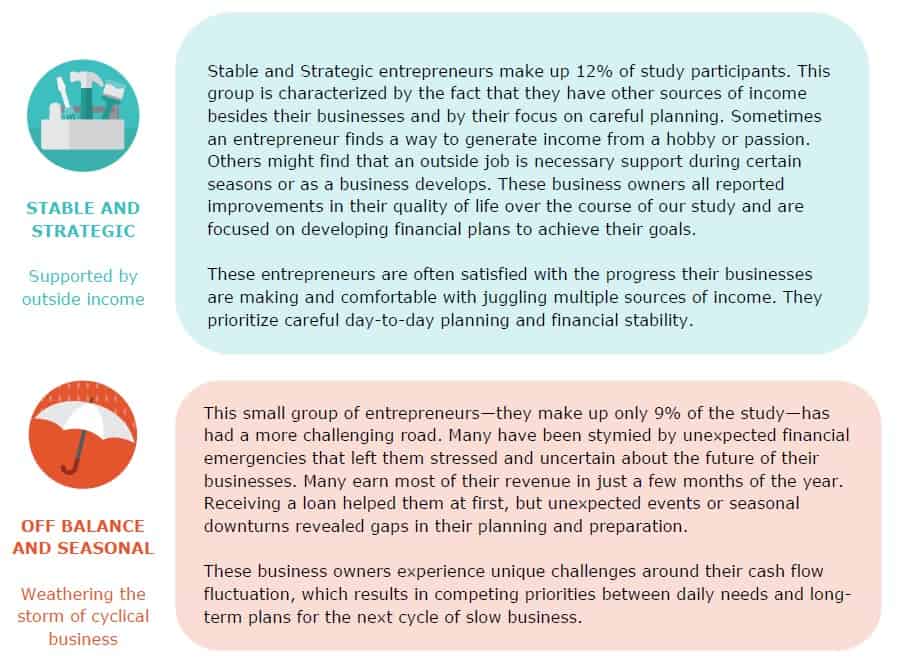

Entrepreneurs are diverse in terms of how they define success, their business acumen, and the support they need to be successful. Analysis of the study’s longitudinal data led to the identification of five distinct types of business owners, each with unique challenges and particular needs. Understanding the different trajectories of each borrower cluster can help small and micro lenders provide targeted support to these entrepreneurs.

Conclusions and Implications

This study further broadens the field of knowledge about the impact of small and micro loans in the United States. We learned that Accion and Opportunity Fund have had a positive impact on business indicators such as cash flow, employee hiring, equipment purchases, and business owners’ personal and household wellbeing. Business owners expressed tremendous gratitude that someone “took a chance” on them, which boosted their self-confidence about achieving goals and provided them with a sense of legitimacy, and a feeling that their business was worthwhile. It is our hope that these findings support practice improvement among Community Development Financial Institutions (CDFIs) who share the goal of supporting businesses who are unable to access traditional financing.

CDFIs are uniquely positioned to support low-wealth individuals and communities, helping them participate in the formal economy. For many entrepreneurs, Accion or Opportunity Fund was the only lender offering affordable, appropriate credit options. This places CDFIs in a unique position to support new and existing entrepreneurs. These institutions can pave the way for women, people of color, and immigrants working to improve their financial security and financial mobility.

More data collection is needed. While this study represents a significant examination of longer-term impacts of mission-based small business lending, there is still more that needs to be understood. For example, in this study we focused on borrowers’ self-reported changes, and didn’t delve into, for instance, the exact amount profits or sales may have risen or fallen.

In addition, one ambitious goal of this study at its outset was to investigate how small and micro loans affect business owners’ communities by exploring how their networks changed over time, looking at the generational implications of entrepreneurship (i.e., how entrepreneurs’ children relate to entrepreneurship), and assessing how business owners contribute to wider community development. However, such metrics are difficult to track in a study of this length and scope, and more research is needed to examine how access to capital for small businesses is linked to community-wide development indicators such as job creation and poverty alleviation over decades.