Kamala Harris Spotlights CDFI Impact on Small Businesses

In her first return to Oakland since elected, Vice President Harris visits an Accion Opportunity Fund client and highlights critical role of Community Development Financial Institutions (CDFIs) in COVID Recovery.

As our nation’s small businesses battle an unprecedented pandemic, Community Development Financial Institutions (CDFIs), like Accion Opportunity Fund’s lending arm Opportunity Fund, continue to stand side-by-side with the smallest, and most underfunded, businesses—namely, those that are led by women, people of color, and immigrant entrepreneurs. This week, Vice President Kamala Harris—a long-time champion of CDFIs in supporting small businesses—visited Accion Opportunity Fund client The Red Door in Oakland, hearing from owner Reign Free about her experience navigating the pandemic.

The Vice President Has Landed

Earlier this week, Accion Opportunity Fund and Oakland small business, Red Door Catering, hosted Vice President Kamala Harris for an event recognizing the strong support CDFIs provided to small businesses during COVID-19. Also attending were Senator Alex Padilla, Congresswoman Barbara Lee, California Lieutenant Governor Eleni Kounalakis, and Allison Kelly, Executive Director of fellow CDFI ICA Fund.

Vice President Harris has been a strong champion for CDFIs, and in 2020, while still serving as Senator, worked to secure $12 billion in federal funding to support the mission-driven nonprofit lenders that provide loans and support to underserved borrowers. The Vice President chose to hold the event at Red Door Catering, a long-time Accion Opportunity Fund client, to showcase what CDFIs can do for small businesses and their communities.

Since 2011, Reign Free, founder, and operator of Red Door has received three loans from Opportunity Fund—along with support from ICA Fund—to help grow her business. Before the pandemic, Red Door catered events across the Bay Area. When COVID-19 struck, Free’s team decided to pivot to providing meals directly to community members in need.

“As a Black woman-owned business, I struggled to get capital and support for my dream. But I never gave up, and Accion Opportunity Fund was one of my first ‘Yeses,’” Free said.

“Throughout the COVID-19 crisis, Accion Opportunity Fund has been there for us as we pivoted and regained our footing. In my business journey, I have faced plenty of obstacles, but I also have seized incredible opportunities. Accion Opportunity Fund helps me shine.”

During the meeting, the Vice President said it best when describing small business owners’ relationship with CDFIs: “They have an idea to grow and need someone to believe in them. To not only help them create a business but then to grow that business, along with technical assistance, along with giving folks an infrastructure.”

“Having Vice President Harris shine a spotlight on CDFIs was a lovely recognition of the work the country’s nonprofit lenders have done to help hard-working small business owners during the pandemic, and important to keeping CDFIs’ ongoing efforts to help our economic recovery front and center,” said Luz Urrutia, CEO of Accion Opportunity Fund on C-SPAN.

“There is a significant need for business credit in America right now and it is crucial that CDFIs have the resources to keep up with the demand and help small businesses to rebuild.”

Brace for Impact

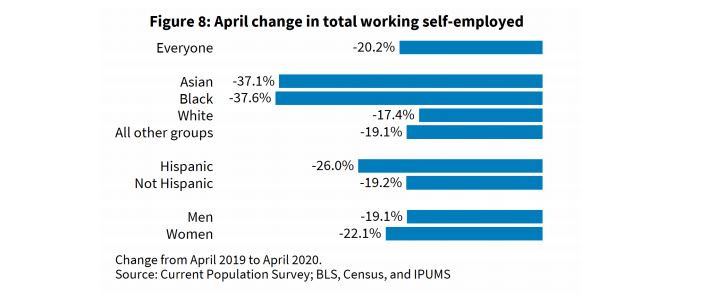

The situation has been dire. Between April 2019 and April 2020, the number of self-employed and working individuals declined by a staggering 20%. More alarmingly, entrepreneurs of color suffered greater declines than average, with the number of Hispanic entrepreneurs declining 26%, and Asian and Black entrepreneurs both declining over 37%. Despite needing support the most, however, reports have revealed great racial disparities amongst those who were able to receive aid, with white business owners receiving more federal assistance than other groups.

This is where CDFIs jumped in. For the past year, CDFIs, mission-focused, small business lenders, leveraged their relationships with funders and government officials to secure the resources necessary to support these microenterprises, ranging anywhere from one-on-one advising to Paycheck Protection Program (PPP) loans to loan payment forgiveness.

To illustrate this point, in 2020 CDFIs provided over 114,000 PPP loans totaling $7.5 billion, with the average loan coming in under $70,000. For perspective, the average PPP loan overall was over $107,000. Over 90% of Accion Opportunity Fund’s clients are people of color, women, or immigrants, and we alone made over 1,100 PPP loans worth $18 million, with an average loan size of $16,000.

This week, incidentally the inaugural California CDFI Week, we find ourselves at a pivotal moment. As the nation makes a turning point in this pandemic, with the number of vaccinations accelerating day-by-day and states and localities re-opening across the country, it’s critical that we not repeat the same mistake—that the smallest enterprises, the very ones that make up the heart of our communities, are not left behind once again in recovery efforts.

The impact of our work is being amplified louder than ever now, thanks to significant recognition from our elected officials, most notably Madam Vice President Kamala Harris. But for us to continue our work at the helm of this recovery, it’s critical that CDFIs are given ample resources.

With Three Times the Demand, It’s Time to Appropriately Fund CDFIs

In FY 2020, CDFI applicant demand for funding was over three times the amount appropriated that year. And the pandemic has revealed the much-needed role of CDFIs in delivering quick, targeted financial assistance.

As regions across the US grapple with re-opening, small businesses still require assistance as social distancing and stay-at-home orders remain in place. This means borrowers will require payment forgiveness and other financial aid from CDFIs as they persevere towards the light at the end of the tunnel.

This return to normalcy also means CDFIs will be called upon to provide working capital and other sources of flexible, patient financing and investment necessary for small businesses, affordable housing, and community facilities to begin long-term recovery.

Without a doubt, the provisions in the last COVID-19 stimulus bill put CDFIs on firmer footing. What is needed next is a continuing level of investment to sustain the effort to revitalize low-income and communities of color that were already suffering even before the pandemic. For these reasons, we advocate for an annual appropriation of $1 billion for the CDFI Fund.

The CDFI industry has ample capacity to put this capital to immediate use. There are over 1,100 CDFIs with assets totaling $211 billion and outstanding portfolios of more than $158 billion. The $1 billion request is less than 1% of total CDFI assets.

SB 625, Delivering Capital to the Heart of California

As California responds to a myriad of economic recovery challenges, natural disasters, and issues of housing affordability and homelessness, the state finds itself looking to establish new programs to deploy resources to impacted communities swiftly.

CDFIs have proven time and again that they can deploy and leverage public investment quickly and efficiently. Most recently amidst the pandemic, CDFIs partnered with the state to push out $21.7 million in low-interest loans through the California Rebuilding Fund, a statewide loan program supporting disadvantaged small businesses with less than 50 employees and revenues of less than $2.5 million. 79% of loans have since gone to businesses historically lacking access to affordable capital, and 86% have gone to microenterprises with less than 10 employees.

SB 625, sponsored by California State Senators Anna Caballero and Monique Limón, would strengthen the California-CDFI partnership to again allow the state to quickly deploy and leverage state, federal, and private resources through CDFIs. The legislation would create a newly-established California Investment and Innovation Fund, to provide loans and grants to eligible CDFIs for various community needs.

The fund will ultimately help provide economic stimulus to struggling communities and establish a repository for future emergency or stimulus funding streams to be administered efficiently and effectively. Alongside the California Coalition for Community Investment (CCCI), Accion Opportunity Fund supports SB 625 and is advocating with state lawmakers on its behalf this week.