5 Tips for Sticking to Your Business Plan

Your business is more likely to succeed if you stick to a business plan, but that's easier said than done. Follow these tips and you'll stay on track.

According to a recent report from Fifth Third Bank, only 51% of business owners regularly follow a business plan. Of those, only 4% turned to bankers for business help. And only 2% use SBA-backed resources.

Written formal business plans are crucial to the success of your small business. Your business plan is a structural roadmap for getting your business off the ground and managing growth. It’s a way to anticipate potential obstacles and plan ahead for major milestones and big purchases. Not only is a business plan important for internal management, but it’s also a major factor in your ability to get funding for your small business. Most lenders expect to see a comprehensive, professional business plan before they’ll give you a loan.

So you’ve put in the research and come up with your business plan – that’s step one. But anyone who’s ever put together a budget knows that creating a plan and actually sticking to it isn’t quite the same thing. You don’t want to just create a business plan and then set it aside; you have to really follow it. So how do you stay on track?

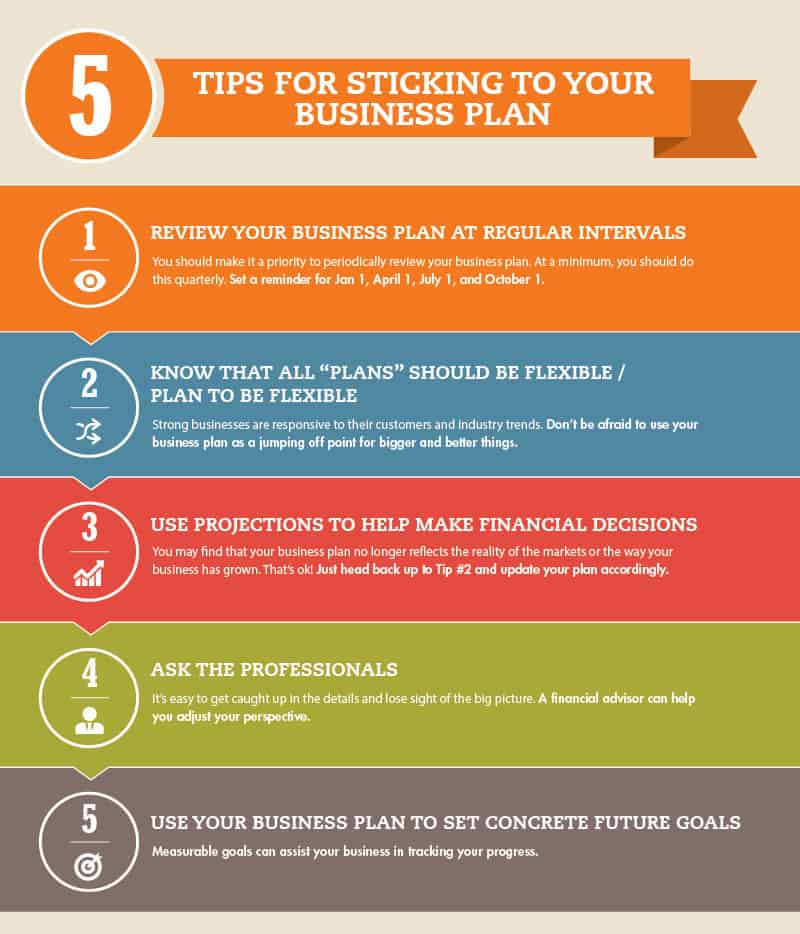

1. Review Your Business Plan at Regular Intervals

The most important tip is the most intuitive: Use it or lose it! Your business plan is not going to do you or your business objectives any good if it’s sitting in a drawer collecting dust. You should make it a priority to periodically review your business plan. At a minimum, you should do this quarterly.

Don’t just skim it over. Actually, take the time to read your business plan from cover to cover. By reviewing your written thoughts, research, and projections, you’ll refresh your memory of what was important to you from the outset. You’ll be able to compare your plan with where your business is now and make adjustments to keep things on track. This is also a good way to revisit the plans and ideas that inspired you to start your business in the first place! Also, consider a mid-year check-in on your overall business. This checklist is a good place to start.

2. Know That All “Plans” Should be Flexible

The best plans (business and otherwise) have a certain degree of flexibility. Whether your projected path has hit some bumps in the road or completely stalled out, it may be time to see if you should take a flexible approach to adhering strictly to the formal plan.

When you first write your business plan, you have no way of seeing what the future will hold – you’re operating based on your research and best guesses. And maybe things don’t pan out that way. Maybe the market drops, maybe it booms, maybe a trend takes off, maybe significant changes in regulation affect the way you do business. Maybe it’s as simple as you selling a whole lot more than you expected! Sometimes, the original plan simply doesn’t fit the reality of the business world. That means it’s time to adjust for these new circumstances. Don’t be afraid to use your business plan as a jumping off point for bigger and better things.

3. Use Your Projections to Help Make Financial Decisions

When you were originally working on your business plan, you relied heavily on projected numbers to estimate your goals and costs. You did the numerical research and crunched all the digits to put into your plan at the start.

Part of the point writing your business plan was to help you get a firm grasp on the costs, expenses, and projected earnings. Review these projected cost and expenses to see if you’re on track for your projected spending. Are your numbers in line with what you had predicted? If not, then use your business plan to help you cut back. If you have additional funds that are unused, then use those funds to supplement elsewhere.

You also used your business plans to make projections about future sales and revenue streams. Do these numbers add up to what you had anticipated? If these numbers are off, then dive into your business plan and see why. What can you do to make the math of your “dream business” (e.g. your original business plan) a reality?

Comparing the numbers, you may find that your business plan no longer reflects the reality of the markets or the way your business has grown. That’s ok! Just head back up to Tip #2 and update your plan accordingly.

4. Ask the Professionals

Whether in business or in life, you don’t have to go it alone. There’s a reason professions like “financial advisor” exist! You may find that market conditions have changed so much that you’re not sure how to adjust your plan. You may find that you’re far from your projections but you can’t quite figure out why. Or you may find that you’ve been a lot more successful than you expected and you’re not sure how to handle expanding this fast.

That’s where the professionals can help. Don’t be afraid to take your business plan to a qualified financial advisor to talk about what you planned, where you are now, and what the future might hold. If nothing else, it can be really helpful to have a third party take a look at your numbers. It’s easy to get caught up in the details and lose sight of the big picture and a financial advisor can help you adjust your perspective.

5. Use Your Business Plan to Set Concrete Future Goals

Your business plan can help you turn lofty, estimated projections into concrete future goals. Measurable goals can assist your business in tracking your progress. Your plan may involve a specific sales goal within a year, for example, or getting a certain number of members. You might also set goals for:

- web clicks

- tweets about your company/product

- likes

- shares

- cash flow

- appointments made

- repeat customers

Take those goals and make them a part of everything your company does. Let your employees know and track the progress so they can see it, too. Picture one of those giant paper thermometers people sometimes use to track donations – it’s an easy, visual way to monitor what’s going on.

It doesn’t have to be an actual paper thermometer, but find some way to make your goals highly visible and make sure to reward your employees (and yourself!) when you hit your mark. That’s a great trick for keeping the goal at the forefront of everyone’s minds and keeping them inspired to shoot for it every day.

Stick to the Plan

You put a ton of work into your business plan – you did the research, thought hard about it, and put all your best ideas together into a roadmap for your company’s future. Don’t let all that hard work go to waste! Take these tips and use them to really build your business plan into your everyday operations. Use that plan to make sure you’re on track, to help you adjust to changing market realities, and to inspire you to meet your goals.

Thank you to Fifth Third Bank for supporting Accion Opportunity Fund in expanding economic opportunity for small business owners.