Five Years Forward: FY25-FY29 Strategic Plan

Small business growth is an economic imperative.

Small businesses are responsible for millions of jobs and trillions of dollars of GDP1. Yet, millions of businesses in the U.S. have been shut out from accessing mainstream financial institutions, especially businesses owned by low- to moderate-income proprietors. Therefore, nearly 80% of small business owners voice concerns about accessing capital2.

Economic potential is everywhere. Responsible capital is not.

Small businesses in the U.S. are growing at an unprecedented rate. Over the past two years, small business owners have launched a groundbreaking 14.6 million new businesses—boosting economic growth nationwide.

Lack of access to capital keeps small business owners up at night and gets our team up every morning to provide them essential funding and resources.

Driving change like no other.

Accion Opportunity Fund (AOF) is the trifecta. We are the leading responsible, sustainable, and scalable non-profit fueling small businesses with the financial and personalized resources they need.

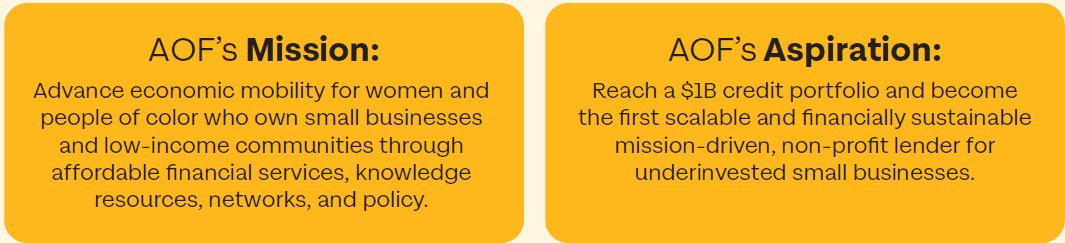

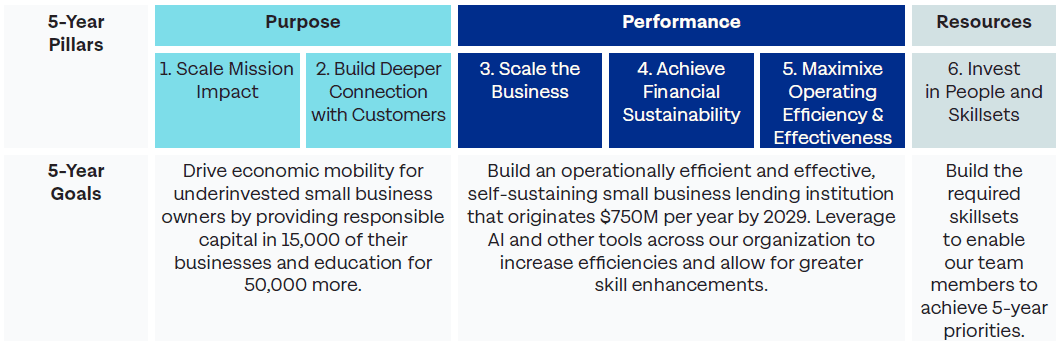

Strategic Plan FY25-FY29

AOF’s commitments for the next five years:

Why AOF?

For more than 30 years, AOF has contributed to a more economic opportunities and robust financial system by making the right bets on our small business owners, acquiring a national digital lending business, merging with a non-profit offering best-in-class business advising and educational resources, investing in programs and partnerships with real ROI.

We address systemic economic disparities faced by underinvested small businesses with the mind of an investor and the heart of a philanthropist.

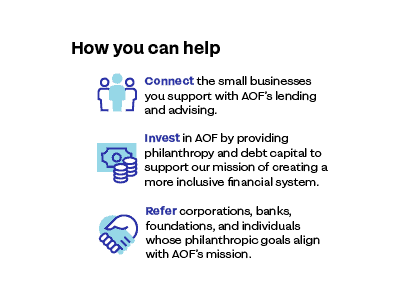

We have cultivated a growing number of funding partners, including banks, foundations, corporations, impact investors, and philanthropists, to accelerate our impact—and theirs.

AOF’s leaders have decades of experience as pioneers in banking, fintech, entrepreneurship, nonprofits, data science and more. All united by an unwavering commitment to our mission and values, ensuring that small business owners who have the resolve, but lack the resources, just don’t get by—they get ahead.

Our Impact is Measurable: AOF’s small business borrowers have benefited from accessing more than $1B through more than 31,000 loans. These business owners, have been able to create and retain 66,000+ jobs. These owners are investing in their local communities across the country and increasing their financial stability, all powered by the resources AOF has provided. We have assisted 4.5M+ entrepreneurs through digital education resources.

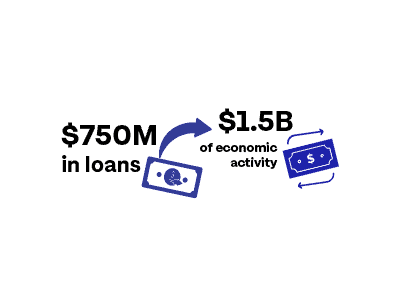

Our strategic plan anticipates that $750M in small business funding will ripple across these communities, generating $1.5B of U.S. economic activity.

How do we do it?

- An extraordinary list of ingredients in the mix: Proprietary digital learning, loan capital, grants, accelerator programs, events, networking, and one-on-one coaching.

- A world-class constellation of partners with top notch expertise.

- Our digital platform and advanced analytics allow us to meet each small business owner “literally” where they are—on their devices, across time zones, in multiple languages. We strive to get entrepreneurs what they need, whether it’s a loan (median time to apply: 12 minutes), to “reach a human” on the phone in Spanish, a one-on-one coaching session, or live chat as they’re closing shop to get home to their families.

- As a Community Development Financial Institution (CDFI) certified by the U.S. Treasury, we leverage federal and state programs to borrow capital at scale from banks, corporations, foundations, philanthropists, and impact investors. This capital allows us to

lend responsibly and reinvest in our platform as borrowers pay us back. - Our evergreen outcome management and learning program assumes we can always do better, measure more, and learn faster.

Be part of transforming the capital landscape for underfunded small business owners.It took almost 30 years to lend our first $750M. This time, we’re going to do it in five years.With the team and platform in place, AOF will fund 15,000 small business owners with responsible capital and serve 50,000 with digital learning. All while achieving organizational financial sustainability.

To execute the plan, we are raising $225M in debt capital and $75M in philanthropy. This additional infusion of capital will enable AOF to expand and diversify our loan portfolio while absorbing loan losses. Additional catalytic philanthropy will allow us to invest in more targeted customer acquisition, as well as new products, technology, data analytics, and operational improvements that will benefit more small businesses while improving efficiencies in our origination and servicing platforms.

AOF’s North Star: Become the first scalable, financially sustainable, mission-driven nonprofit lender for underinvested small businesses in the U.S.

Contact Verónica Figoli, Chief Development Officer, with questions or to support

1 U.S. Chamber of Commerce, Small Business Data Center, May 2024. https://www.uschamber.com/small-business/small-businessdata- center.

2 Goldman Sachs 10,000 Small Businesses Voices, “Glass Half Full: Small Business Owners Optimistic About 2024 Despite Challenging Business, Lending Environment,” January 2024. https://www.goldmansachs.com/citizenship/10000-small-businesses/US/ infographics/glass-half-full/index.html.