Evaluating Customer Experience of the First CDFI-fintech partnership

Today, we’re pleased to release new findings from our evaluation of the partnership between Opportunity Fund and LendingClub.

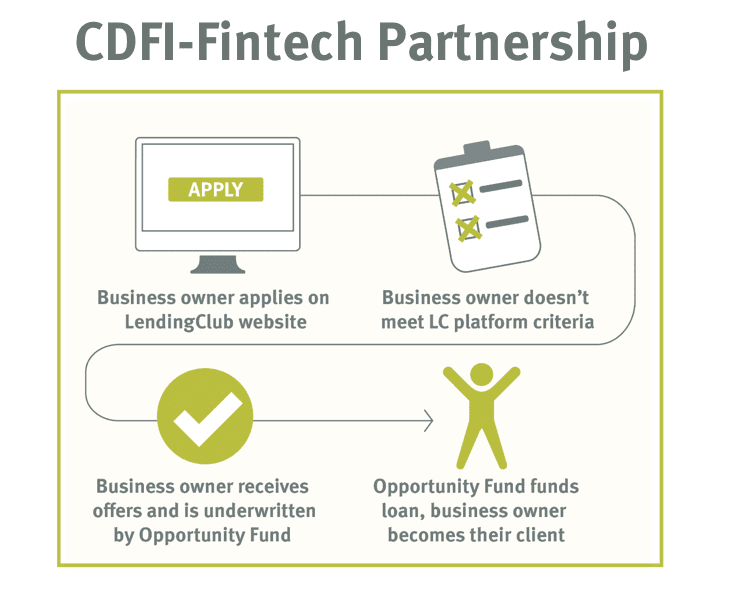

Today, we’re pleased to release new findings from our evaluation of the partnership between Opportunity Fund and LendingClub. The report, High-Tech, High Touch: Evaluating the Customer Experience for the First-Ever CDFI-Fintech Partnership, highlights key findings from qualitative phone interviews with borrowers who received a loan from us through the LendingClub platform referral. As the first-ever CDFI-Fintech partnership, we built on last year’s evaluation of this innovative collaboration by hearing directly from the small business owners who are benefiting from it.

With generous financial support from JPMorgan Chase, Opportunity Fund worked with partners at Palmer Research and Baccus Research to conduct interviews with our borrowers to better understand their experiences and preferences. Specifically, our qualitative research goals included:

Determine online borrowers’ experience and level of satisfaction with the loan process- Ascertain the level of connection borrowers have with Opportunity Fund and the qualities that drive that connection

- Determine if the experience differs for LendingClub vs. bank-referred borrowers

- Learn how Opportunity Fund can better cultivate a relationship with its online borrowers

After conducting and analyzing 35 borrower interviews (25 with LendingClub-referred borrowers and 10 with a comparison group of bank-referred borrowers), our researchers found:

- Clients are highly satisfied with their Opportunity Fund experience:

Experiences with Opportunity Fund are very positive for both online and offline borrower

Clients appreciate the personalized service and feel that Opportunity Fund cares about them and their business

Clients are highly satisfied with the efficient process and fast turnaround time

Nearly all would return to Opportunity Fund in the future

Borrowers felt a sense of fairness in working with Opportunity Fund - While there was strong satisfaction, a few borrowers identified areas for improvement:

- Time zone challenges for borrowers outside CA

- Some confusion around LendingClub’s “pre-approval” marketing (e.g., fliers and advertisements, prior to loan application) vs. final approved loan amount

- Additional business supports would be appreciated, although borrowers are not dissatisfied with the current level of support

- Credit reporting – business vs. personal

Borrowers overwhelmingly expressed satisfaction with our services, and only a small number cited these challenges when pressed by the researcher conducting the interview.

At Opportunity Fund, we are committed to using what we learn from research to continually improve the work that we do. We know from this research that our borrowers appreciate the high-tech approach, but don’t want to lose the human element – the high touch that sets CDFIs apart from many other lenders. How can we best serve our clients with the best of both of those approaches?

1. Provide education about high-cost alternative loans: Sometimes, our borrowers want a bigger loan than they can realistically afford, and they may find another lender that is willing to make them a larger loan—but at a greater cost. We work to help our borrowers understand what they can truly afford and the pitfalls of some alternative lending products, so they can make the best decision.

2. Leverage the expertise of partners to offer resources to customers: We are partnering with other providers of technical assistance to leverage their expertise and their ability to offer resources to our clients.

3. Bring the best aspects of our online lending to our other lines of lending: We are exploring how we can create a better process for ALL of our borrower segments, not just online borrowers.

4. Explore how to reward returning borrowers: When a borrower is ready for their second or third loan, we want to make the process easier and reward them for their loyalty. We are exploring providing more favorable terms to returning borrowers, as well as a more streamlined process to show our borrowers that we care about their business and long-term success.

To learn more about these interviews and what we learned from our borrowers, download the slides from the presentation.