National Truth in Lending Advocacy Update

Individual consumers are protected by the Truth in Lending Act (TILA), which requires transparent disclosure of loan terms, fees and annual percentage rates (APR) of loans. Small businesses, however, are not covered by this law, leaving them vulnerable to misleading or irresponsible lending practices.

Individual consumers are protected by the Truth in Lending Act (TILA), which requires transparent disclosure of loan terms, fees, and annual percentage rates (APR) of loans. Small businesses, however, are not covered by this law, leaving them vulnerable to misleading or irresponsible lending practices.

For years, Accion Opportunity Fund (AOF) has been concerned by the lack of transparency provided to small businesses seeking financing – a problem requiring urgent action, particularly in light of COVID-19’s detrimental impact on small businesses. Businesses are desperately searching for financing to bridge losses in revenue due to the pandemic, cover immediate expenses, and avoid closure.

In 2016, Opportunity Fund conducted a study on the prices charged by short-term, high-cost alternative lenders and found that businesses were charged average APRs of 94%, and up to 350%, without those APRs ever having been disclosed to the borrowers. Particularly during this time of crisis, choosing an unaffordable financial product could be the difference between success and failure for small businesses that are already closing at high rates due to COVID-19-induced business interruptions. Without transparent disclosures, small business owners of color are disproportionately impacted by high-cost predatory lenders. Small businesses are critical to the health and vibrancy of our local and national economy. We must help them succeed.

AOF is a founding member of the Responsible Business Lending Coalition (RBLC), a unique cross-sector coalition of nonprofit and private-sector fintech lenders and advocacy organizations, that have worked together since 2015 when the RBLC published the Small Business Borrowers’ Bill of Rights. These Rights represent the first cross-sector consensus on responsible small business lending standards and have been endorsed by over 100 nonprofit and private-sector organizations. Below you will find an update on our TILA advocacy efforts in California, New York and Washington, D.C. which have all been guided by these rights.

California – Commercial Financing: Disclosures

California is on the verge of implementing the first financial protection bill in the nation for small business owners, a cause that AOF has championed since the law was introduced in 2018. In a strong bipartisan manner, California was the first in the nation to establish Truth-in-Lending laws to protect small business borrowers by passing SB-1235. For the past two years, AOF has been working closely with the California Department of Business Oversight (DBO), now the-soon-to-be Department of Financial Protection and Innovation (DFPI), on regulations to implement this law.

Status: Pending final rulemaking and implementation by the newly established DFPI.

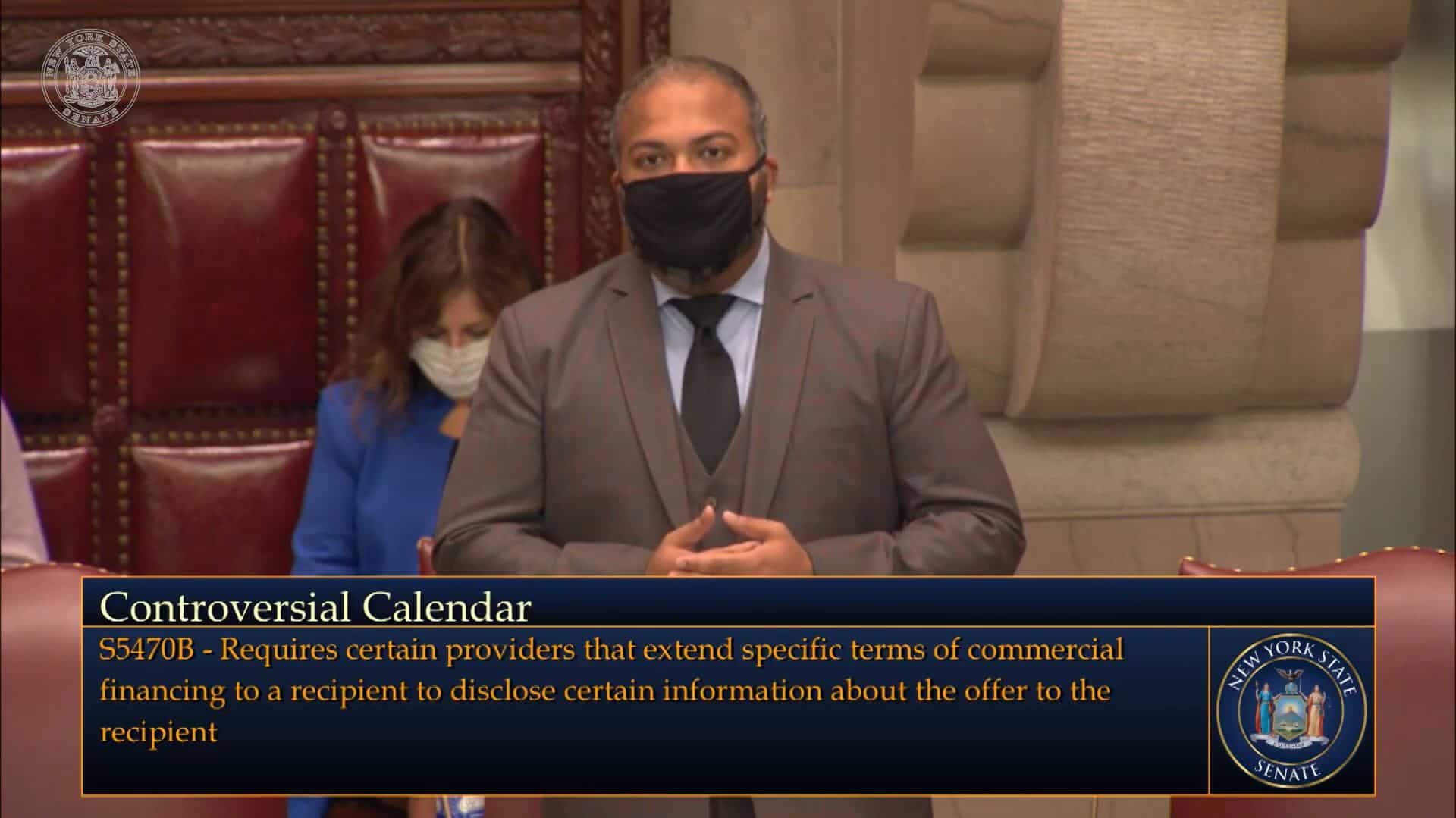

New York – Small Business Truth in Lending Act

AOF and the RBLC worked closely with Assemblyman Kenneth Zebrowski and State Senator Kevin Thomas to build on our policy efforts in California to bring stronger protections to small business owners in New York state. Unlike the regulatory back and forth in California, New York’s Small Business Truth in Lending Act includes many of the policies needed to protect small businesses in statute, like disclosure of annual percentage rates (APR). The bill passed the New York State Legislature in July 2020, again, in an overwhelmingly bipartisan manner.

Status: Awaiting Governor Andrew Cuomo’s signature.

Federal – Small Business Lending Disclosure and Broker Regulation Act of 2020

In July, Congresswoman Nydia Velázquez, the Chairwoman of the House Small Business Committee, introduced new legislation aimed at protecting small business borrowers from predatory lenders and loans carrying unfair terms and conditions. This historic federal bill builds upon our state advocacy efforts and includes many protections enjoyed by consumers through the Truth in Lending Act.

If passed and enacted into law, we project this bill will bring over $3.8 billion in savings for nearly 800,000 small businesses annually, including hundreds of millions in savings for over 158,000 minority-owned small businesses. We encourage leaders in Congress to work together to pass this historic law, prioritizing the needs of small business owners across the country.

Status: Introduced in July 2020. Transparency in Small Business Lending hearing held on September 9, 2020.