Ripple Effect, The Macroeconomic Impact of Small Business Lending

The purpose of this study is to aggregate these activities—the direct, indirect, and induced economic effects of microloans—to calculate the “ripple effect” or macroeconomic impact of Opportunity Fund’s lending on California’s economy. Opportunity Fund (the lending arm of Accion Opportunity Fund) commissioned TXP, Inc. to measure this impact using objective, verified research methods because we believe rigorous economic analysis is critical to advancing our mission and fulfilling our responsibility to our investors to fully measure the return on investment from their support.

Methodology

TXP, an economic analysis and public policy consulting firm, created a customized econometric model using an input-output analysis to measure the macroeconomic impact of Opportunity Fund’s lending in California. The data set included 7,551 small business loans made throughout the state by Opportunity Fund between April 1995 and December 2015.

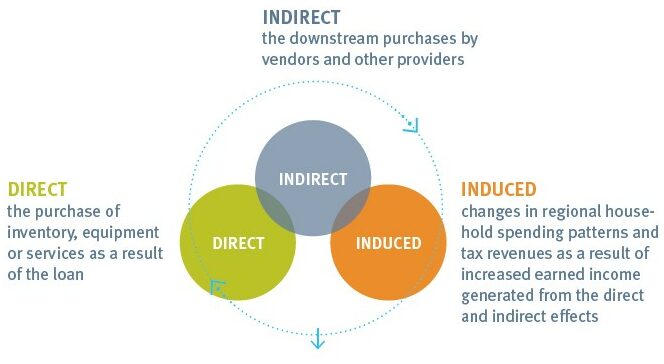

To start, TXP used Opportunity Fund’s $131 million in loans as a measure of the initial annual injection into the economy. TXP then measured the anticipated total economic impacts of these loans, using the industry and location of each business and a system of regional input-output multipliers developed by the U.S. Bureau of Economic Analysis called RIMS II. The analysis takes into consideration three types of expenditure effects:

Key Findings

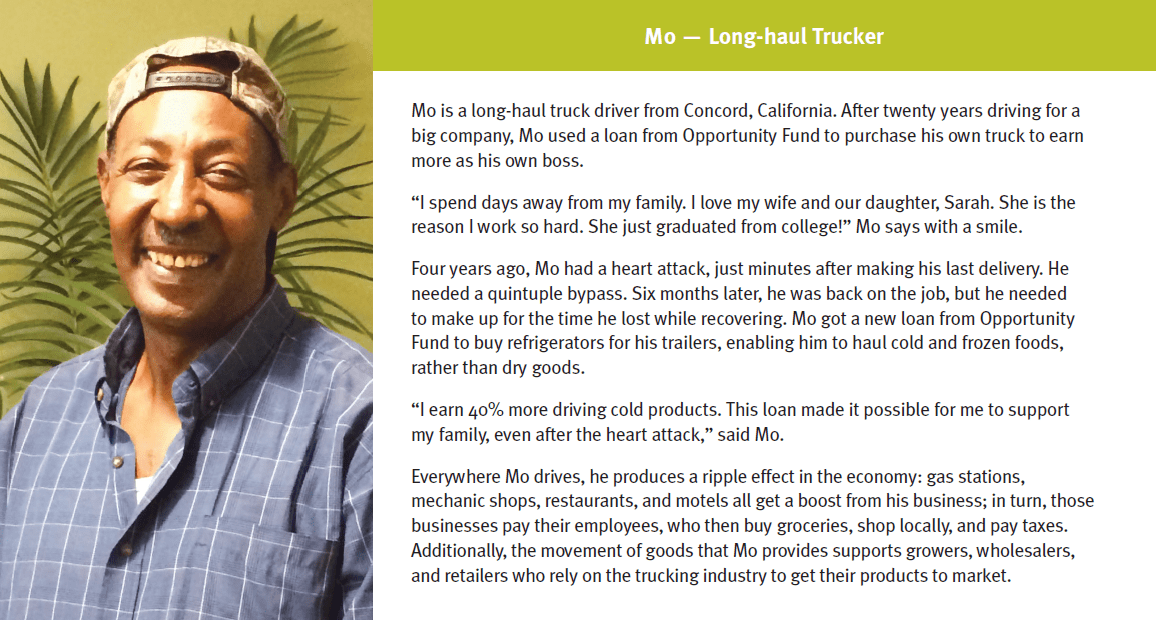

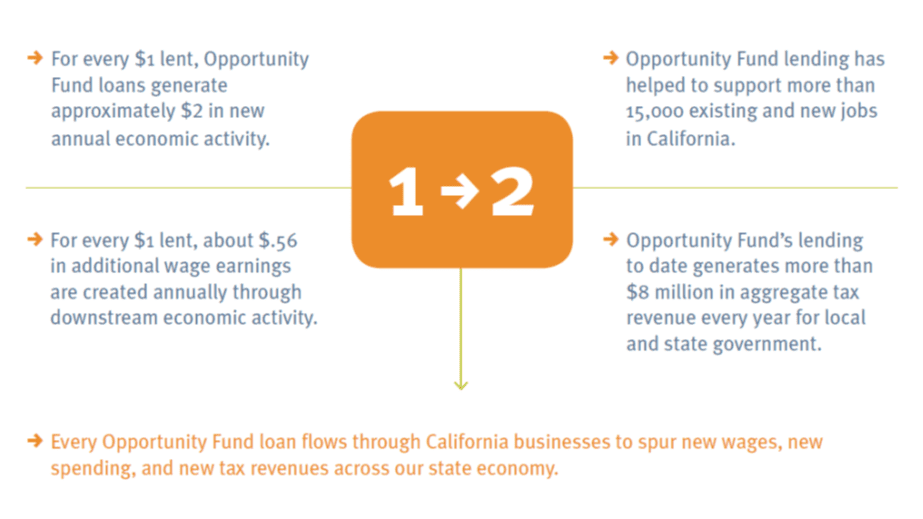

The economic impacts of Opportunity Fund’s loans extend far beyond the individual borrower. The provision of capital to small businesses affects the economy in a number of ways. Many of these benefits, however, occur over a number of years after the loan, as businesses grow, add employees, pay taxes, and increase payrolls. Lending to small businesses can have an “evergreen” effect, as a sustainable business by definition provides services to its customers, wages to its employees, and returns to its owners on an ongoing basis.

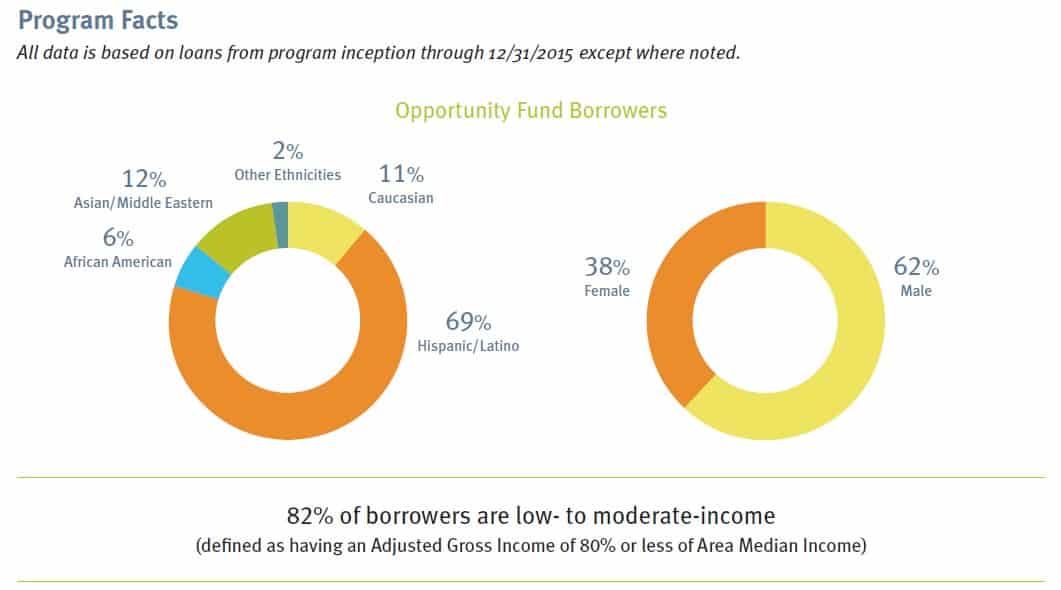

Opportunity Fund provided 7,551 loans and approximately $131 million in total funds between 1995 and 2015. With more than 90% of our borrowers still in business at least 2 years after receiving a loan, TXP’s economic model found these loans to have the following impacts:

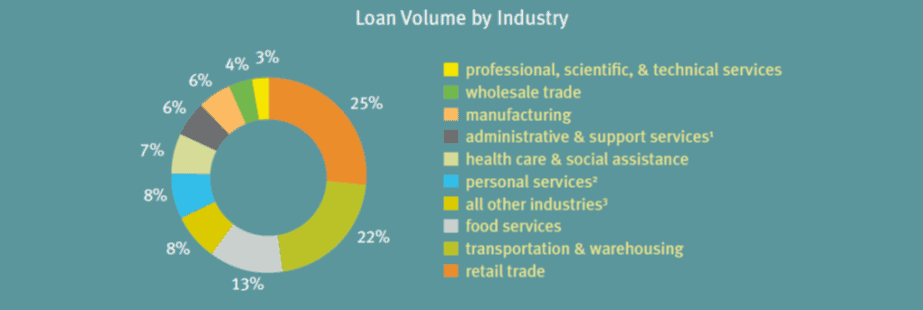

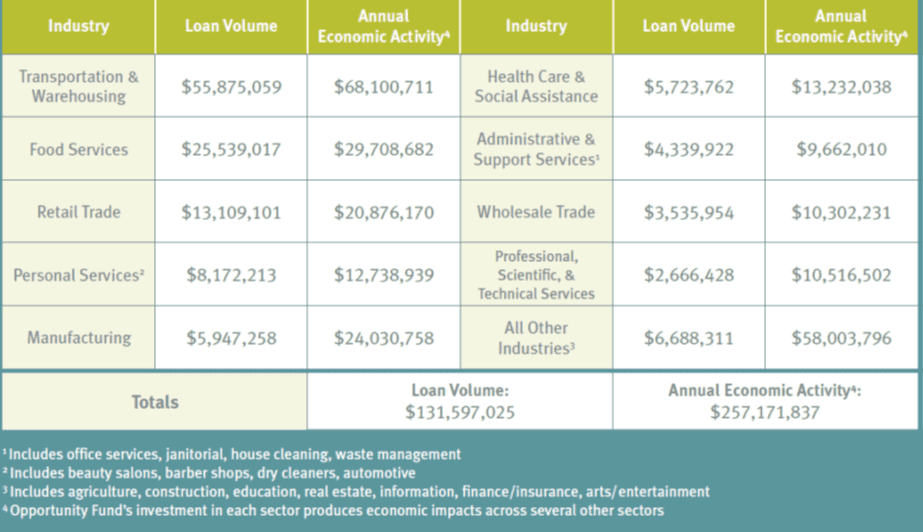

Impact by Industry

This economic analysis takes into account the industry and location of each borrower, as different industries and regions produce different direct, indirect, and induced economic effects. As shown below, nine industries comprise more than 90% of Opportunity Fund’s lending and account for 77% of the new economic activity generated by these loans.

Opportunity Fund’s borrowers reflect the incredible diversity of businesses in California. More than 80% of the borrowers in this study are low- to moderate-income individuals, and many lack significant formal education or English fluency. Yet each business contributes to the local and state economies, regardless of scope and size. In fact, Opportunity Fund’s lending in key industries—including trucking, mobile food, small-scale retail, and personal services—does more than provide direct injection of capital into the individual business. It also generates economic activity in downstream industries that are connected through transportation, purchasing, and other business related activities.

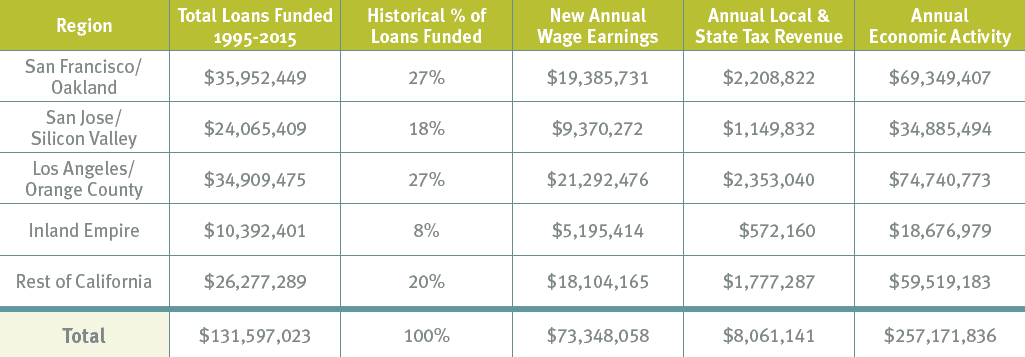

Impact by Region

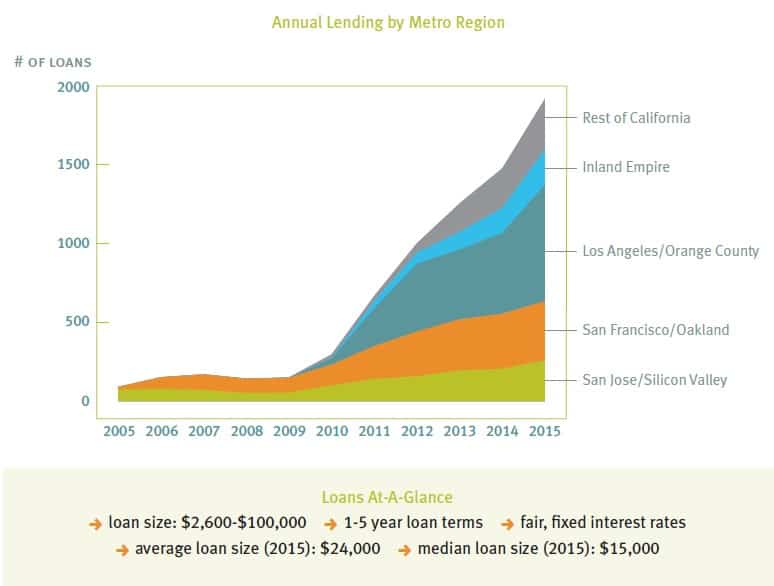

Prior to 2012, Opportunity Fund served only the San Francisco Bay Area. In 2012, lending expanded to include the Greater Los Angeles region, with subsequent growth to serve the entire state of California. In the five years since statewide expansion, lending volume has increased dramatically across all of our lending areas.

Opportunity Fund Borrowers

Small Loans. Big Impact.

To give your own small business a boost, explore our small business loans and how they can help

Small businesses play a major role in the modern American economy. California is home to 3.6 million small businesses, which drive economic opportunity across the state. Individually, the businesses are small; collectively, the role of California’s entrepreneurs in the economy cannot be understated: small businesses employ our workers, strengthen our neighborhoods, and reinvest in local communities.

Opportunity Fund believes that small amounts of money and financial advice can help people make permanent and lasting change in their own lives, driving economic mobility and building stronger communities. We say “Yes!” to small business owners, low-income students, and families because entrepreneurship, education, and sound financial habits are proven pathways to greater economic opportunity. Our strategy combines microloans for small business owners and microsavings accounts to help students pay for college. As California’s leading microfinance provider, our team has deployed nearly $150 million and helped more than 12,000 people since 1994.

TXP is an economic analysis and public policy consulting firm based in Austin, Texas. For 25 years, TXP has helped clients understand and respond to their most pressing economic and public policy issues. By blending analysis and creativity, TXP crafts custom solutions that are thoughtful and straightforward. Our innovative ideas not only enable community and business leaders to anticipate and manage the economic forces affecting their region, but also show them how to define issues from the beginning. Using customized econometric models that simulate regional economies, TXP measures client projects’ economic impacts, as well as effects on the local tax base. TXP has conducted analyses for several U.S. microlenders and nonprofits, including two earlier editions of this macroeconomic analysis for Opportunity Fund in 2010 and 2011.