Prepare to Access Capital for Your Small Business

Learn how to prepare your business for an influx of capital and how to evaluate loan options in our webinar, co-hosted with Fifth Third Bank, and find the best fit for your situation.

Watch Our Webinar Recording on Preparing to Access Capital

Set yourself up for business success

In this webinar, presented in partnership with Accion Opportunity Fund (AOF) and Fifth Third Bank, lending experts Shanna McLearn, Director of Working Capital and Community Partnerships at AOF; Adriana Williams, Partnerships Manager at AOF; and Juan Guevara, Small Business Community Lender, from Fifth Third Bank, share important details about accessing capital for your small business. The presenters will walk you through not only how to make sure your business is ready for an influx of capital, but also how to evaluate various capital options and find the best fit for your situation.

Whether you’re looking to stabilize your business or exploring growth opportunities, an injection of capital could be exactly what you need. This presentation covers three key steps to preparing to access capital in the form of loans: formalizing business finances, exploring funding options that match your business needs, and preparing for the application process.

Topics discussed in this webinar include:

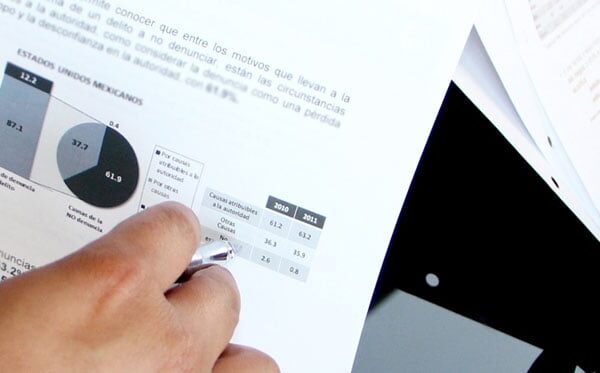

- 3 critical financial documents for small businesses: profit and loss, cash flow statement, and balance sheet

- Alternative (non-bank) lenders

- Questions to ask your lender before you agree to a loan

- Avoiding predatory lending

- What to consider when evaluating a loan

- How lenders evaluate your income, debt, and cash when determining the terms of your loan

- How lenders evaluate your credit score, collateral, and connections when determining the terms of your loan

- The supporting documents commonly required by lenders as part of your loan application

- The benefits of forming a relationship with a financial institution

- Community Development Financial Institutions like Accion Opportunity Fund

- Banks with strong small business lending programs like Fifth Third Bank

Learn more about Accion Opportunity Fund and how we help could help your company with a small business loan.