Crafting Compelling Small Business Grant and Loan Applications

Unlock your funding potential with key skills to create compelling small business grant and loan applications.

In this webinar, designed for small business owners seeking to secure small business grant or loan funding, you will gain valuable insights and practical strategies to enhance the quality of your applications. With expert guidance, you will learn how to create persuasive proposals and increase your chances of securing funding.

Watch Our Webinar on Crafting Small Business Grant and Loan Applications

Meet the Experts

Lindsay Chung

Lindsay Chung is a Program Manager and business coach at Accion Opportunity Fund and has more than 12 years of experience in the accounting and finance industry. Lindsay has worked with hundreds of small business owners across more than 20 different industries. From startups to established businesses, she has helped businesses understand their credit and ways to improve it along with advising them on how to manage their cash flow, analyze their financials, and improve their bookkeeping practices. Lindsay first realized her passion for economic empowerment while proudly serving as a Peace Corps Volunteer in Botswana. She has a Bachelor of Science in business administration, accounting and finance from the University of Colorado.

Jeannette Flores-Katz

Jeannette Flores-Katz was born and raised in El Salvador. Through Kosher Guacamole Corp. Jeannette, with her husband, uses high quality ingredients and shares Salvadoran food and culture to Atlanta. Jeannette personifies entrepreneurship and is dedicated to self-development and the mentorship of women in Atlanta.

Small Business Grant and Loan Options

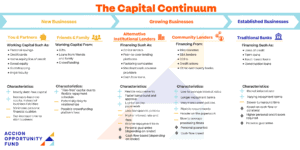

Types of Capital

There are many different ways to finance your business, including multiple different kinds of debt capital (like loans, merchant cash advance, credit cards), grants, or equity investments. The following chart outlines common types of capital based on your stage in business. It is important to be aware of the many different types of capital and their typical characteristics so you can make an informed decision about the best type of capital for your business.

Choosing the Right Type of Capital

When evaluating your financing options, it is important to choose the best type of capital for your business. In addition to knowing exactly how much you can afford, it is essential to evaluate the lender and make sure that its lending options are right for you and your business, just as much as the lender is evaluating you as a borrower. Companies that are not regulated and bound by state treasury laws typically offer loans full of hidden fees and fluctuating payment schedules. These daily or weekly repayment schedules can strip business owners of the cash they need to operate.

When evaluating a financing offer, you want to look for traditional terms such as a monthly payment schedule, easily understandable terms, and APR. When it comes to daily or weekly payments, proceed with extreme caution. Depending on your cash flow, it may be best to avoid such a loan because it can hurt the future of your business. Lenders that do not clearly share upfront the cost of a loan or who advertise that they’ll give you fast cash without asking for details about your business may have something dangerous to hide. If you are considering a loan, be sure to familiarize yourself with predatory lending practices and techniques to protect your business.

Applying For Grants

As the economic impact of the COVID-19 pandemic became clear, many big corporations, government agencies, and non-profit organizations started programs to support entrepreneurs that included small business grants. Many of these programs have continued to this day. Some programs provide only a grant to selected applicants, while others provide additional resources in addition to a small business grant.

Additional Benefits of Educational Programs with Grant Components

Many programs include educational resources, coaching, networking, and marketing opportunities in addition to a grant upon successful completion of the program.

- Educational programs often introduce you to small business resources you might not have know about before, on both a local and national level. AOF’s free Business Resource Library and Interactive Short Courses are an excellent resource for many small business needs.

- Weekly or monthly classes on relevant small business topics. Jeannette recognizes that these classes can be a commitment in the already busy schedule of a small business owner. However, the benefit of the, often virtual, classes is that you are forced to to work on your business instead of in your business. That mindset also helps you learn to step back from the day to day of your business, train and put faith in your team to do their jobs, and reach the next phase of your journey as a business owner.

- Some programs also include coaching from expert business coaches, who can advise you on your business’ unique needs.

- Many educational programs incorporate networking with fellow business owners. Networking is your opportunity to get and share ideas with your peers and business experts. You never know what you are going to learn. Jeannette recommends going into these program with an open mind. In her experience, you will always learn something valuable, so make the most of the opportunity.

Where to find grants

- AOF’s Programs Page. Many of our educational programs have grant components.

- HelloAlice.

- Sign up for newsletters.

- Local, state, and national organizations that support small businesses.

How to craft a compelling grant application

you don’t always know what they are looking for. Make sure you meet all eligibility requirements, but don’t give up and keep applying. Jeannette applied for a particular grant three times before she was accepted. There’s no one formula for success, but you need to be prepared.

- Read carefully what they are looking for or who the program is for

- Share your dream. They are looking for people who are passionate about your business

- They want to see you as successful and so they want to see someone who will maximize the impact of the funds on their business

- They also want someone who will take advantage of any other components of the program, like educational or coaching resources

Grants attached to ed programs are often less competative than grants that don’t have educational resources as part of the program. You also get additional benefits like coaching and educational resources to help your business succeed.

They can be a pain to do. Jeannette called applying for them as a job in and of themselves.

Tell them as much as you can about your business. Focus on telling your story, sharing how you would use the funds, and how that would impact your business

Save all of your grant applications, especially the answers to any questions, so you can re-use them on future grant applications, and so you can go back and reflect on your business goals and responses over time.

Grant apps offer a fantastic opportunity to reflect on your business, seriously and strategically consider your goals, and make a plan for your business. Business owners are so busy that it can be hard to find time to work on your buisness, not in your business. Grant or loan applications can force your to prioritize that time.

You just have to go for it. You don’t have to be overqualified or at your absolute finest. You’ll learn through the process and you may, in fact, win a grant along the way.

Applying For Loans

What Lenders Look For

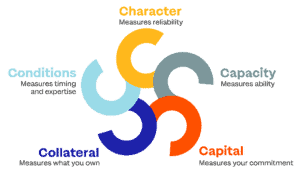

Submitting an application for financing can feel like putting your request into a black box. Often, you don’t know what is going on inside the box and you don’t know what will come out the other side. What do lenders actually look for in a loan application? In general, they are trying to determine how likely it is that an applicant will be able to repay the loan. To determine that likelihood, they evaluate a loan application based on the 5 C’s.

- Character: This is typically represented by your credit report. For most small businesses, lenders will review your personal credit report and score. To build your business credit, in additon to your personal credit, you will need to apply for a DUNS number. To begin building business credit, Lindsay recommends starting with your banking institution and getting a secured business credit card. Make payments in on time and in full to build your credit. Over time, see if you can move to an unsecured business credit card.

- Capacity: This measures your ability to afford a loan payment. Capacity is typically measured with your debt service credit ratio. Lenders need to insure you have enough net income to cover your expenses, current debt, and future or potential debt. For newer businesses, to determine net income, lenders review financial projections. Make sure your projections are well researched and supported based on industry or competitor numbers.

- Capital: This measures your financial commitment to your business. Lenders want to make sure you have skin in the game and a personal investment in the business. To evaluate this, lenders will typically examine your balance sheet.

- Collateral: This is an asset you own that you pledge to secure the loan. That means that if you default on the loan, the lender would typically take ownership of that asset. Not all lenders require collateral, but many do, especially for purchases of real estate or major equipment.

- Conditions: This involves an evaluation of cirumumstances that may impact your ability to repay the loan. Lenders will typically consider how you plan to use the funds, your industry outlook, and the trajectory of the overall economy.

By considering the 5 C’s, lenders determine if they can offer you a loan, how much you will be offered, and under what terms.

Tips for Success: Small Business Grant and Loan Applications

Share Your Unique Value

- “I can give you my recipes but your final product won’t come out the same as mine”, Jeannette shared. As a business owner, you put your own unique touch your products and services, just like Jeannette puts on hers. You might sell similar products or services to your competitors, but your story, passion, and approach make you and your business unique. Share your story in a concise, articulate package.

- Be genuine. Not everyone is going to like you or what you sell. Your best customers will like you because of who you are and how you sell it or present it. Customers (and application reviewers) are looking for a clear and genuine picture of who you are and what you sell. For this reason, using grant writers can be hit or miss. Reviewers want to hear your voice in an application or interview.

- Personalize your pitch each time you apply for a grant. Each time you apply, you will be in a different position than you were the last time you submitted an application, so you have to update your pitch accordingly. Also, because each grant targets different business owner profiles, focuses on different aspects of a business, or asks different questions, it’s essential to tailor each pitch or application to that particular grant or loan.

- Don’t be ashamed or shy. Share where your business is really at at the time of application. Talk about your goals for your business, and how you plan to reach those goals with the grant or loan funding. While successful small business grant and loan applications need to be open and genuine, be cautious about giving away your “secret sauce” or any other intellectual property in an application.

Know Your Numbers

Part of applying for a loan is sharing your business’ financial situation with lenders. Finances can be intimidating and it can be very helpful to have a bookkeeper that helps you day to day, but you still need to understand the basics of your financial reports and budget so you can speak confidently to lenders about your numbers and your business.

- Know your credit score. Look it up and keep an eye on your credit report. Keep in mind that having too many inquiries on your credit report can be considered a negative by lenders.

- Know what you can afford. Understand your cashflow and avoid predatory lending situations like merchant cash advances.

- Know how you will use the funds and write a specific plan. Calculate exactly how much you need. Don’t ask for too little, since can be hard to get additional capital, but don’t ask for too much either, since you don’t want to pay interest on funds you don’t really need. When presenting your request, use the following template as the outline for your pitch: I am asking for $ [amount] to use for [specific reason], which I project will increase or improve [sales/output/profit/revenue] by [amount or percent].

- For example, a taqueria might say “I am asking for $7000 to purchase an automated tortilla machine. We know house made tortillas are very popular with our customers and based on current sales and customer surveys, we project that house made tortillas will increase revenue by 9%.

Organize Your Documents

- Keep all of your business and personal documents in order.

- Submit everything that a grant application asks for. If you don’t understand a question or request, ask the organization for clarification.

- Once you have it on order, applications become much easier. Be sure to keep documents and information updated.

- Create a business plan. Even when you make major business purchases with your own funds, you need to know your numbers, have a plan, and understand how that purchase will help you reach your business goals. Loan and grant application reviewers want to know the same thing.

- When you talk to lenders, treat it like a job interview. You are being interviewd and you need to be prepared with financial documents, business documents, and relevant market research. Lenders want to know how your business will generate income to be able to pay back the lender and how your expertise will contribute to that success. You are also interviewing the lender. Make sure you are prepared to ask questions so you fully understand how the lender operates and the terms of any loans for you are offered or educational programs to which you are accepted.

Accion Opportunity Fund also offers small business grants as part of our educational programs. Check out our current programs here.

Do you need advice around crafting small business grant and loan applications for your business? Sign up for free one-on-one coaching with our expert business coaches, including Lindsay Chung. As Jeannette says, it takes a village to build a village, so don’t be afraid to ask for help for any and all resources that are available to you.