Our 5 Year Plan

Imagine a world where small businesses can access responsible capital and the knowledge they need to succeed.

AOF lends to traditionally underserved small businesses. We’ve proven our lending model and are now at the tipping point of becoming self sufficient. If we succeed, we’ll shift how lenders and investors view underserved small businesses and unleash a wave of economic activity—for small businesses, their employees, their communities, and the entire economy.

That future is within reach. The cycle of financial exclusion can be broken. You can help us cross the finish line and change the ecosystem for thousands of small businesses.

There’s a “missing middle” in small business lending

A $100 billion annual market gap exists for small business loans1 in the US. Nearly 80% of small business owners say it’s hard to access capital.2

These potential borrowers are often low-income and underserved by the traditional financial system. Without funding, they either go out of business or borrow from predatory lenders— tying generations into a cycle of crippling debt or failing.

We’ve uncovered the potential of an underserved market

Through laser focus on our target market and decades of testing and learning, we’ve gotten better and better at taking calculated risks and lending to those most banks overlook.

They’ve grown their businesses. And they’ve paid us back. In fact, their repayment rate is 90% or higher. When they succeed, their communities benefit.

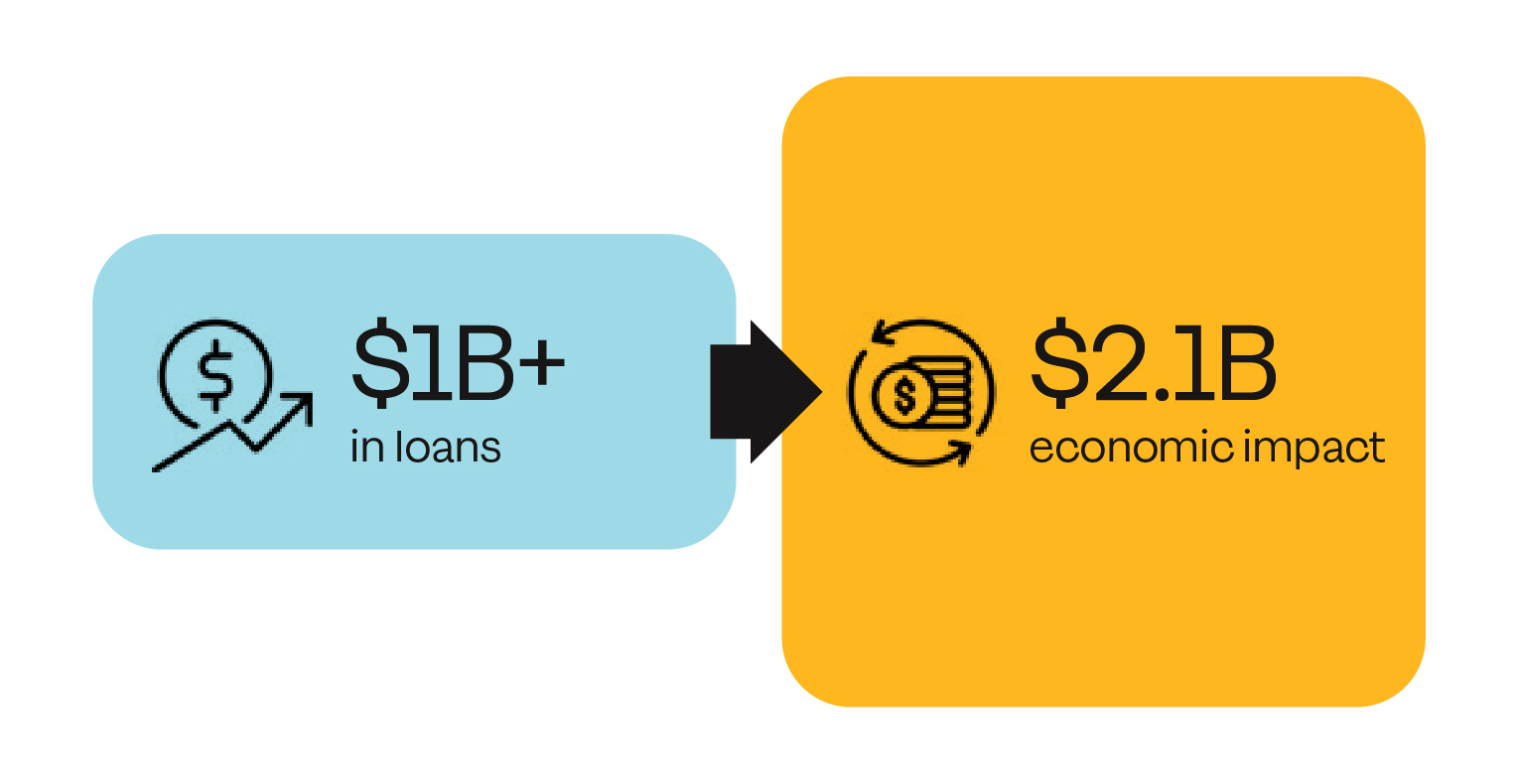

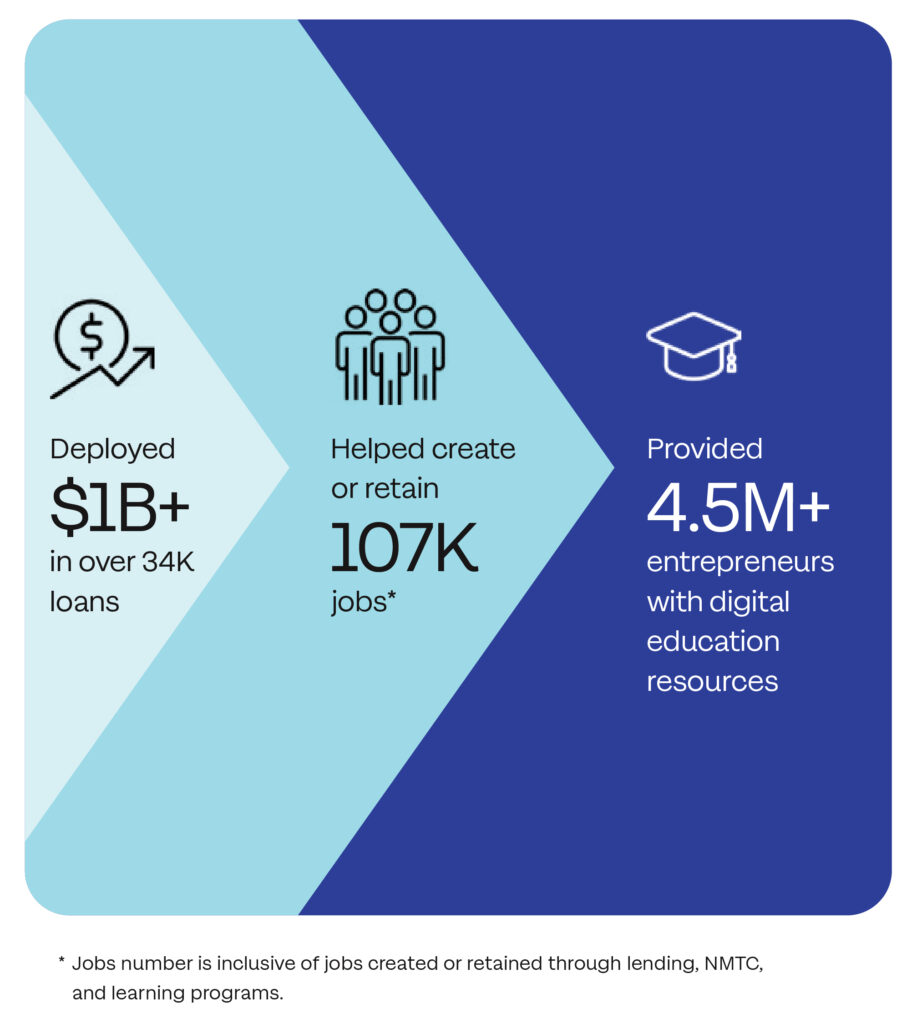

We’ve figured out the model for scaled impact

Our Impact: At a Glance

We not only focused on borrowers that most lenders ignore, but doubled down on them. Where others saw risk, we saw opportunity, and we built an ecosystem to support them.

Our approach enabled us to break through typical constraints:

Adaptive and underwriting: With focus comes foresight. We deeply understand our borrowers’ unique situations and have built proprietary and automated underwriting models that improve over time. We look holistically for markers of creditworthiness.

High-touch + high-tech: We pair digital tools with live loan specialists who can guide customers, many of whom are first-time borrowers, through complicated processes.

Beyond lending: We provide free education, resources, and community-building to set businesses up for success. The trust and goodwill we’ve built in these communities not only lead to better repayment rates but also to referrals to other creditworthy borrowers.

Expanding through digital + partnerships

We evolved from boots-on-the-ground outreach to digital customer acquisition. We’ve streamlined processes while maintaining personal support. We formed partnerships with other entities like Lending Club, Intuit, Mastercard, and PayPal, who have helped us scale, cut costs, and refine our approach. And the results are impressive: we’ve scaled our lending and learning platform, increased our impact, and come a step closer to profitability.

We’re a leading, national, mission driven small business lender, but we still only address a fraction of the market. At scale, we can become completely self-sufficient and serve exponentially more borrowers.

Our Mission

Advance economic mobility for underinvested small businesses and low-income communities through affordable financial services, knowledge resources, networks, and policy.

Our Ambition

Reach a $1B credit portfolio and become the first scalable and financially self-sufficient, mission driven lender for underinvested small businesses.

We proved it works; now we’re at an inflection point

Struggling communities across America need—and deserve— more than incremental impact. AOF has the potential to become the first fully self-sufficient, mission driven small business lender serving businesses that often can’t otherwise access affordable loans.

For over three decades, AOF has built an efficient model for affordable, scalable small business lending.

We know the elements that go into the model. We can lend responsibly and we are profitable on a contribution level in some—but not all—of our businesses. But we haven’t done it at scale.

To make the entire operation self-sufficient, we need to invest more in our operations and meet the following goals: access customers at greater scale, modernize our credit model, and create a better customer experience.

Finally, to scale nationwide and become fully sustainable in our lending business, AOF must evolve our funding model away from low-cost capital and philanthropy towards market-rate debt. We will make this change in two phases.

This strategic investment and debt capital will enable us to accomplish the following:

Let’s Build More Together

Just as our borrowers are stuck in a cycle where they can’t grow, we can’t grow without access to capital.

Fund our mission-driven lending model or provide philanthropic support for our work.

Your investment doesn’t just sustain AOF. It fuels a revolution in small business success.

How you can help

Connect the small businesses you support with AOF’s lending and advising.

Invest in AOF with philanthropy and/or debt capital and help us build a more inclusive financial system.

Refer corporations, banks, foundations, and individuals whose philanthropic goals align with ours.

1 Defined as loans under $100K, with revenue under $1M and working capital requirements $50k to $100k to purchase inventory, make payroll, etc.

2 Goldman Sachs 10,000 Small Businesses Voices, “Glass Half Full: Small Business Owners Optimistic About 2024 Despite Challenging Business, Lending Environment,” January 2024, Goldman Sachs.