From the Frontlines in the Microfinance Revolution

This article was originally published by the Federal Reserve Bank of San Francisco in Community Investments, Winter 2014/2015 – Volume 26, Number 3 35.

Notes from the Frontlines in the Small Business Finance Revolution: A Microlender’s View

By Gwendy Brown and Eric Weaver

Where do you go for your morning coffee? To get your car serviced? To get your hair or nails done? Small businesses are not just beloved local service providers – they also create roughly two-thirds of all American jobs.1 Over the past decade, more and more of these businesses are being funded by lenders outside of the financial mainstream. This article explores the rise of alternative and subprime business finance and the implications for Main Street business owners. Drawing on Opportunity Fund’s direct experience successfully lending to thousands of low-income and minority entrepreneurs across California, we reflect on the opportunities and challenges presented by this small business finance revolution and share some potential product and policy solutions.

Background

Ten years ago, the financing options for a small business2 such as a salon or restaurant were fairly straightforward, though not always easily accessed. A business would go to a bank or credit union and apply for a loan. If the application was denied, for most businesses there was only a limited range of secondary options to consider: credit cards or microloans (though they were not well known at the time). Today the picture is very different, with some bad news and some good.

The Role of Banks In Small Business Lending is Shrinking

The bad news is that since the recession banks simply are not lending to many small businesses, especially those needing a loan of $100,000 or less. According to the Federal Deposit Insurance Corporation’s (FDIC), bank commercial loans of $1 million and under have declined consistently each year since the financial crisis and are still 20 percent below pre-recession levels, even though loans above $1 million have recovered completely.3 California alone saw a decline of over 60 percent in Small Business Administration (SBA) lending between 2007 and 2013.4 Asking business owners directly, one observes the same trend. In the Federal Reserve Bank of New York’s most recent Small Business Credit Survey, only 58 percent of loan applicants nationwide were approved, an approval rate decrease of 5 percent just in the past six months5, which amounts to 8,000 requests for financing denied every business day.6

Observers suggest that there has been a perfect storm of factors keeping bank lending to small businesses so low.7 At the micro level, many small businesses still have not recovered from the recession, meaning that their revenues, personal or business credit, or collateral cannot support traditional loan requests. In many areas, small community banks, which used to do a sizable portion of small business lending, are closing or consolidating. Banks are more heavily regulated in the wake of the financial crisis, which makes it even more costly for them to process smaller and riskier loans including those to small businesses.8 For all these reasons, it seems unlikely that banks will reenter the small business lending space to a significant degree in the near future.

New Players are Changing the Field

At the same time, innovations in lending have opened new avenues to commercial borrowers. A small business owner now is as likely to apply for financing from her computer, phone or mailbox as she is to apply at a local bank, and an entire ecosystem of alternative financing options has become available for small businesses. Although still minor players relative to banks, alternative small business finance is doubling each year and is already estimated at nearly $25 billion per year.9

For the purposes of this article, we define ‘alternative financing’ as any loan or other financing provided to a small business that is not provided by a bank or credit union.10 (Although some alternative financing products are loans, others are structured so as not to meet the legal definition of a ‘loan’, which is an important distinction we will discuss later on.) Alternative financing encompasses tremendous variation in business practices including how borrowers apply for the loan; the rates they pay (from prime to upwards of 100 percent APR); how they repay the loans (monthly check or daily pull from checking or merchant account); and where the money comes from (individual investors, hedge funds, institutional investors and banks).

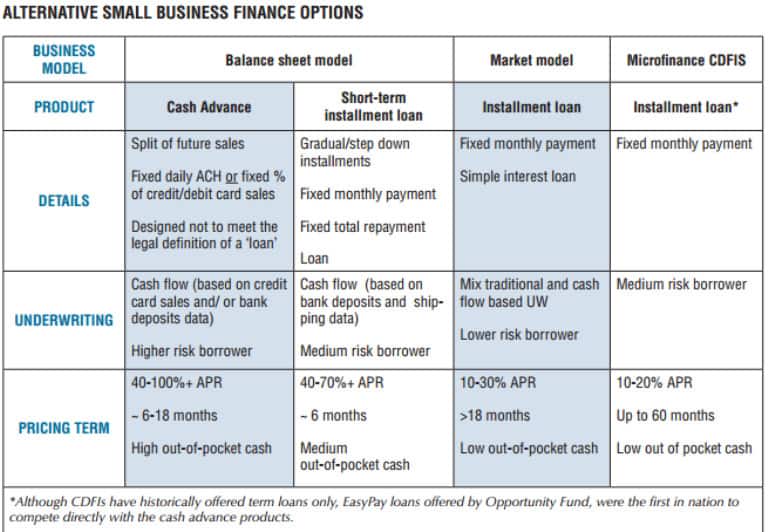

In general, we have seen two main business models emerge for alternative small business financing companies.11 The first, which we call the ‘balance sheet model’, follows a more traditional process: a finance company borrows money against its own balance sheet and lends that money out. The model is similar to banks except that these companies are generally unregulated and the loan products offered are non-traditional and often subprime. The second model, which we consider to be the more innovative approach, is the ‘market model.’ This model garnered a lot of attention when it was first known as ‘peer to peer’ or ‘crowd funding,’ but those labels are increasingly inaccurate. In the market model, financing companies act as intermediaries between investors and businesses.

Although there are no hard and fast rules, newer market-based lenders often offer lower cost products than balance sheet model companies for a variety of reasons such as more automated underwriting and lower infrastructure costs. In addition to these two primary business models, alternative financing is also available through subsidized nonprofit microfinance organizations (such as Opportunity Fund), which are often organized as Community Development Financial Institutions (CDFIs). The table below lists some of the main types of alternative financing currently available, along with general information about underwriting criteria and pricing.

Benefits of Innovations in Alternative Finance

For many small businesses, the good news with this new array of options is that they can actually qualify for needed financing. Alternative financing brings capital to many businesses that could not get approved for bank loans. A second benefit is that the application process is much simpler and faster. An entrepreneur can apply for financing online (or on their phone) in less than 30 minutes, including automatically sharing bank statements and other documents. Many set up automatic payments during the application process, and some lenders can wire funds in as little as two to five days. Compare that with the average of 33 hours that businesses estimate it takes to apply for bank financing12 and the weeks to months it can take to approve and fund the loan. For busy business owners with limited time to dedicate to securing new funding, access to faster financing and a less cumbersome application process are very welcome features of these new loans.

the downside of Alternative Financing Options

For many new loan products, however, initial time and money-saving innovations may come at great long-term cost to the business. Many business owners are surprised to learn that some of these alternative products carry annual percentage rates (APR’s) which can exceed 100 percent, and they wonder whether those prices are truly legal. The reality is that many cash advance products are carefully designed to avoid being classified as loans, and, as a result, are not subject to any state or federal oversight (beyond basic business licensing and contract law).13 For example, in California, state lending law applies to installment loans but it does not apply to cash advances, which are technically a purchase of future revenue for a fee. Free from regulation, many companies do not choose to report their pricing in standard terms (APR) but rather communicate price as a ‘factor’ or ‘multiple,’ meaning the cents charged per dollar borrowed. This makes it challenging for an entrepreneur to truly compare financing options, especially when the proposed repayment terms (number of months) vary.

For example, a cash advance company might ask an applicant to compare two advance offers for a $30,000 loan: a factor of 1.17 for a six month term (17 cents per dollar borrowed) or a factor of 1.24 for a twelve month term (24 cents per dollar borrowed). Business owners often select the cash advance with the shortest repayment term, because the total dollar cost is lower. The advance with the shorter payback period carries a higher APR (63.4 percent versus 44 percent in this example), however, and more importantly, it is a bigger drain on the monthly cash flow of the business. For an advance to be paid back in such a short time period, the business owner must make very high daily payments. When the payments exceed the business’ profit margins, the business starts to experience negative cash flow, which threatens its viability.

Because the initial cash advance cuts too deeply into a business’ cash flow to be sustainable, often the business will turn to another financing company to provide an additional advance, a practice referred to as ‘stacking.’ Stacking is a clear sign that a business is experiencing significant cash flow challenges.

Stacking: A Real Life Example

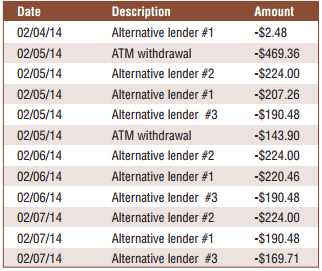

Here is a real life example we have seen in our lending. A five-year old bakery in Southern California was making approximately $2,400 in average daily sales. The business originally got $16,000 in cash advance financing, with a daily payment of $136. By the time the bakery came to Opportunity Fund to apply for a $100k loan, they were making daily financing payments to four different companies – three pulling directly from their checking account and one pulling from their credit and debit card sales.

A real life example of stacking:

bank statement from a bakery in Southern California

Withdrawls and debits.

(Finance company names have been removed)

Not shown: Merchant Cash Advance taking 20% of daily sales

In total, the bakery was making over $600 in daily debt payments, which ate up more than 25 percent of their daily cash. For a food business such as a bakery, where profit margins are roughly 10 percent, this level of indebtedness is not sustainable in the long term. Unfortunately, Opportunity Fund was unable to approve the loan request because the business had insufficient cash flow to repay a new loan, even if their existing debt was refinanced at our lower rates and longer terms. As of this writing, the bakery appears to have closed.

Lack of Credit Building and Debt Transparency

In addition to high repayment obligations, businesses taking out some types of alternative loans do not see the positive, credit-building benefits of borrowing. Many alternative lenders and financing companies do not report debt and repayment to the major credit bureaus, which is an optional practice. Some lenders choose not to report for competitive reasons. They know that their competitors can purchase lists of their borrowers from the credit bureaus in order to market to them for a new ‘stacking’ loan. Others, such as MCA (Merchant Cash Advance) lenders, cannot report to credit bureaus because their products are not structured as loans.

Lack of credit reporting is problematic both for the business owners taking on the new debt and for other lenders considering those businesses for financing. Positive repayment history is the top determinant of a strong credit score. For business owners taking out alternative financing, many of whom sign a personal guarantee to repay the loan, the lack of credit reporting means this opportunity to build their credit is lost. This is especially detrimental for immigrant and low-income business owners who may have thin credit histories or some negative marks on their record, as a reported record of on-time payments could significantly strengthen their credit score. By missing the chance to build their credit in this way, many entrepreneurs end up weighed down by more costly sub-prime financing, even when they exhibit ‘prime’ repayment behavior.

For lenders, lack of credit reporting also means a lack of transparency into the true indebtedness of a potential borrower. For example, when ‘alternative financing’ started to grow, at first Opportunity Fund could not make sense of our applicants’ business financial records because it appeared that significant amounts of their revenues were disappearing, until we realized it was siphoned off before the sales ever hit their bank account. Given the high and increasing volume of alternative financing to business owners across the country, limited transparency translates into potential risk for future lenders. Although a lender can also determine debt levels by looking at other documents such as bank and merchant statements and by consulting private search engines, this is more costly and less consistent than accessing all of the needed information from a standard credit report.

Product Focus: Easypay

Alternative financing brings both opportunity and risk; when these can be balanced, business owners stand to benefit. Opportunity Fund has been lending to small businesses since 1994. In 2013 we became the first and only CFDI in the nation to expand our product offering beyond installment loans when we began actively competing with alternative financing companies with a new product called EasyPay. Previously, Opportunity Fund had offered standard term loans in amounts from $2,500 to $100,000 to a variety of small and microbusinesses ranging from flea market vendors and home-based businesses to salons and mobile food trucks. In developing the EasyPay product, we took note of MCAs and saw the tremendous upside of matching loan repayment directly with cash flow. A term loan is paid in equal installments, regardless of the sales a business does. An EasyPay loan, by contrast, is repaid in accordance with the business sales – more when business is good, less when business is slower.

EasyPay is a loan product that provides the benefits of a MCA (including simple repayment and easier qualification), without the significant downsides outlined in the sections above. EasyPay is priced comparably with other Opportunity Fund products, with interest rates starting at 8.5 percent. Through underwriting we ensure that no more than 10 percent of a business’ revenues go to covering debt payments, and provide a payback period of up to 36 months, rather than the average eight month payback period of MCAs. Finally, because EasyPay is structured as a loan rather than as a cash advance, all repayment is reported to the credit bureaus.

With the extra security of automatic daily payments, EasyPay makes it possible for Opportunity Fund to finance businesses who might not qualify based on our standard underwriting. Currently, applicants can qualify for EasyPay financing even if they have lower credit scores, more recent late payments, and/or less time in business. In addition, collateral requirements for EasyPay borrowers are more flexible, allowing Opportunity Fund to issue larger loan amounts with longer repayment terms against the same level of collateral. As a result, EasyPay has helped Opportunity Fund to double our lending to certain higherrisk segments such as restaurants since we rolled out this new product, and we are exploring new underserved industry segments to reach out to next.

Where to Go from Here

As we have noted earlier in this article, the landscape of small business finance is undergoing a radical transformation. While improvements in speed, convenience, and product options for loan applicants are welcome, there are real concerns about affordability and long-term sustainability for the businesses taking on this new kind of debt. In the current market, we see a gap between the actual price many businesses are paying for capital and the price they should be paying based on their risk. In short, even with the transformation underway in alternative lending that is beginning to thaw the credit freeze, small businesses are paying too much to access capital. In the sections below we explore some potential opportunities for promoting innovative products and responsible practices to ensure this small business finance revolution truly benefits the Main Street businesses that form the backbone of our economy.

Promoting Innovative Products and Encouraging Responsible Practices

The rise of alternative small business financing should signal to traditional lenders some key indicators about what businesses actually want and need. For one thing, businesses are looking for a low-hassle process when applying for new financing. For busy entrepreneurs time truly is money, and they often base more of their decisions on ease and convenience than other factors. Lower pricing by itself is no longer a sufficient competitive advantage, at least on smaller loans.

Further, there is major experimentation underway in consumer lending around how to evaluate a loan applicant in non-traditional ways. New factors might include social media profile data and even an applicant’s behavior when completing a loan application, such as time spent reading the fine print. Yet in business lending we see that the majority of alternative lenders (especially the balancesheet variety) rely almost exclusively on cash flow from business checking and merchant accounts to determine eligibility for financing. Sophisticated lenders can and should research how to expand their ‘credit boxes’ to reach new segments by incorporating new data sources, rather than just evaluating the business solely on its cash flow.

How one business moved from a merchant cash advance to EasyPay

Jorge went to his local bank to get financing for a popular Peruvian restaurant he owns with his two brothers. He had previously taken on multiple merchant cash advances (MCAs) so that he could purchase the space next door and build a bar and lounge for waiting diners, with the intention to increase revenue. The merchant cash advance payments were taking too much from his sales and suffocating his cash flow, however, so he asked his banker for help. The bank was unable to help Jorge due to some challenges in his credit history, but they connected him to Opportunity Fund, which issued to him a loan to pay off his merchant cash advance balance as well as to provide additional working capital. With this new sustainable loan, Jorge’s payments are more comfortable for his business. He was able to finish his expansion project and can now start building his credit so that he can qualify for traditional banking products in the future.

Banks, CDFIs, and other responsible lenders may continue to have a competitive advantage to the extent that they can provide larger amounts of financing to qualified businesses. Very often, businesses take on multiple cash advances not only because the high daily payments for each advance cut too deeply into their cash flow, but because the initial loan amount approved was less than what the business truly needed. If traditional lenders can successfully approve higher loan amounts than cash advance competitors, it will fill a critical need for entrepreneurs outside the shrinking ranks of businesses that currently qualify for bank financing.

Finally, the new regulatory framework that emerges to guide small business finance should also find a balance between facilitating ongoing innovation and reigning in excessively risky and abusive practices. A strong first step in this direction might be a requirement that any entity providing business and commercial financing should be subject to consistent regulation and oversight, regardless of the specific products they offer.

Best Practices and Conclusion

As we have learned in twenty years of making loans to small businesses, commercial lending is a nuanced and complex process that varies by lender as well as by the specific business seeking financing. This variation is appropriate given the vast array in sizes, scopes and types of small businesses in our economy. However, there are three best practices that are relevant and appropriate for all business financing. These practices include:

1. Price transparency: Lenders should disclose the true cost of financing in terms of APR to allow small business loan applicants to compare financing options. For products such as cash advances with flexible repayment terms, this should include a chart of estimated APRs based on a range of potential repayment periods.

2. Credit Reporting: It would benefit all parties for small business lenders to report repayment history to one or more major credit bureaus whenever possible.14 Consistent reporting of repayment is not only essential for individuals to build credit and access more favorable terms over time, but also for lenders to accurately calculate debt obligations.

3. Ensure Ability to Repay: Lenders should perform underwriting on loan applications to verify ability to repay, based in part on business cash flow.

Small businesses provide jobs for millions of Americans, fostering vibrant local neighborhoods and helping to ensure the growth and stability of a strong national economy. The tremendous creativity and efficiency represented in the best of alternative business financing should be replicated and rewarded. Yet the ongoing and potential future damage from unregulated, nontransparent financing cannot be ignored – by business owners, policy makers or the public. Great strides have been made to expand consumer protection as new, flexible loan products emerge. The same level of oversight and protection is necessary among these new alternative business financing products to ensure America’s entrepreneurs are not harmed and can continue to build thriving businesses in their communities and across the nation.

Endnotes Notes from the Frontlines in the Small Business Finance Revolution: A Microlender’s View

1 https://www.sba.gov/offices/headquarters/ocpl/resources/13493

2 For the purposes of this article we define small businesses as businesses with less than $1 million in annual revenues and less than five employees.

3 http://www.hbs.edu/faculty/Publication%20Files/15-004_09b1bf8b-eb2a-4e63- 9c4e-0374f770856f.pdf

4 http://calreinvest.org/system/resources/W1siZiIsIjIwMTMvMTIvMjMvMTdfMTNfNTJfOTQzX0NSQ19TbWFsbF9CdXNpbmVzc19SZXBvcnRfMjAxMy5wZGYiXV0/CRC%20 Small%20Business%20Report%202013.pdf

5 http://www.ny.frb.org/smallbusiness/Spring2014/

6 http://microcapitaltaskforce.com/

7 For a comprehensive overview of these factors please see a recent report working paper from Harvard Business School: http://www.hbs.edu/faculty/Publication%20 Files/15-004_09b1bf8b-eb2a-4e63-9c4e-0374f770856f.pdf

8 http://www.clevelandfed.org/research/commentary/2013/2013-10.cfm

9 http://www.foundationcapital.com/downloads/FoundationCap_MarketplaceLendingWhitepaper.pdf

10 Other alternative business financing such as accounts receivable finance and purchase order finance and have been excluded here as those products typically serve mid-sized businesses rather than small businesses.

11 Thanks to Brian Graham of Alliance Development for sharing this framework.

12 http://www.ny.frb.org/smallbusiness/Spring2014/pdf/summary-of-key-findingsSPRG2014.pdf

13 In addition, many online lenders partner with banks located in states with lax usury laws,

14 Credit reporting may not be possible when the entity is a corporation and the loan is not secured with a personal guarantee by the owner(s) of the business.