The True Cost of Capital

Income fluctuates when you’re an entrepreneur. Sales can change for a myriad of reasons, ranging from predictable seasonality to unexpected competition. With this, a business owner’s available cash and ability to re-pay debt inevitably change as well. We presented “The True Cost of Capital” – a webinar detailing just how much a typical small business owner would pay for various financing products under realistic repayment conditions.

The webinar is the third and final study in a series funded by the JPMorgan Chase Foundation and its Partnerships for Raising Opportunity in Neighborhoods (PRO Neighborhoods) initiative. PRO Neighborhoods is a $125 million, five-year program that seeks to provide communities with the capital and tools needed to address inequality in their neighborhoods. PRO Neighborhoods accomplishes this by investing in Community Development Financial Institutions (CDFIs) like Opportunity Fund, the lending arm of Accion Opportunity Fund.

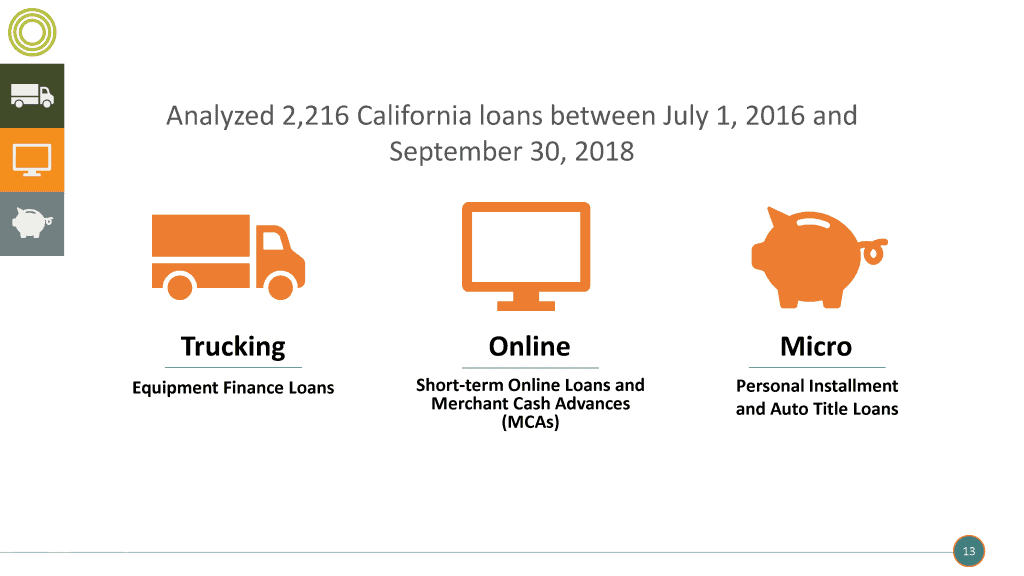

In our research, conducted by Financial Health Network (formerly the Center for Financial Services Innovation or CFSI), we studied our trucking, LendingClub (hereby referred to as “online”), and micro loans to create typical borrower and loan profiles for each group. We then compared our products to their respective marketplace alternatives – equipment finance loans, short-term online loans, merchant cash advances (MCAs), personal installment loans, and auto title loans.

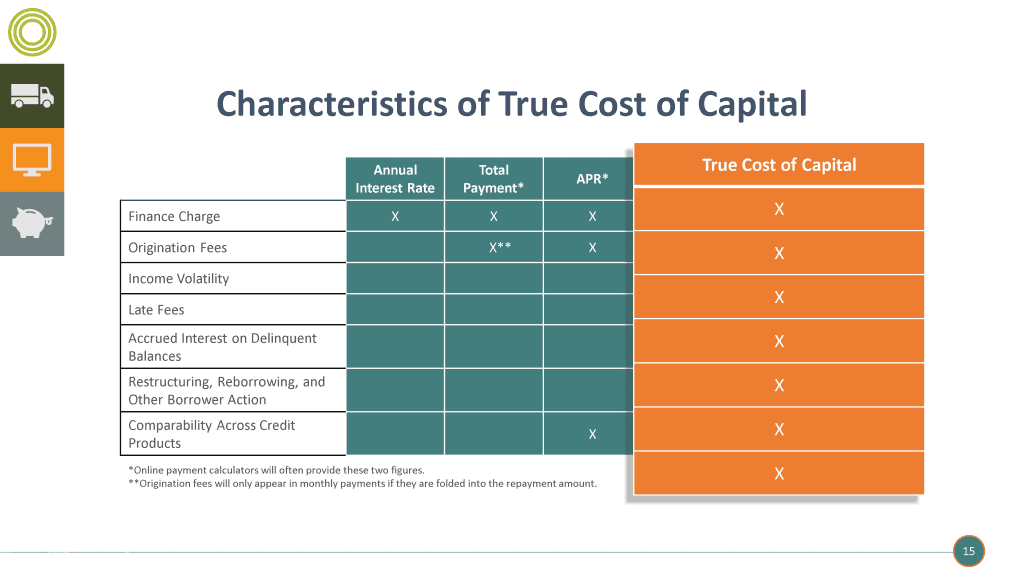

The true cost of capital takes into account late fees, accrued interest on delinquent balances, restructuring, reborrowing, and other borrower action as a result of income volatility; it was essential that we captured this in our repayment scenarios.

Key Findings

We discovered along the way that:

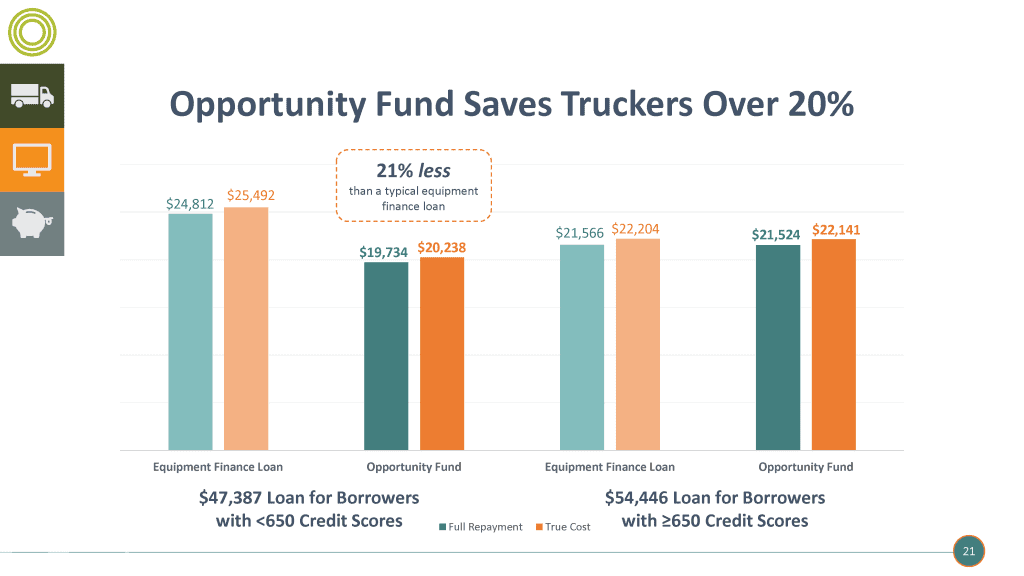

- Our trucking loans cost 21% less than typical equipment loans for borrowers with credit scores below 650.

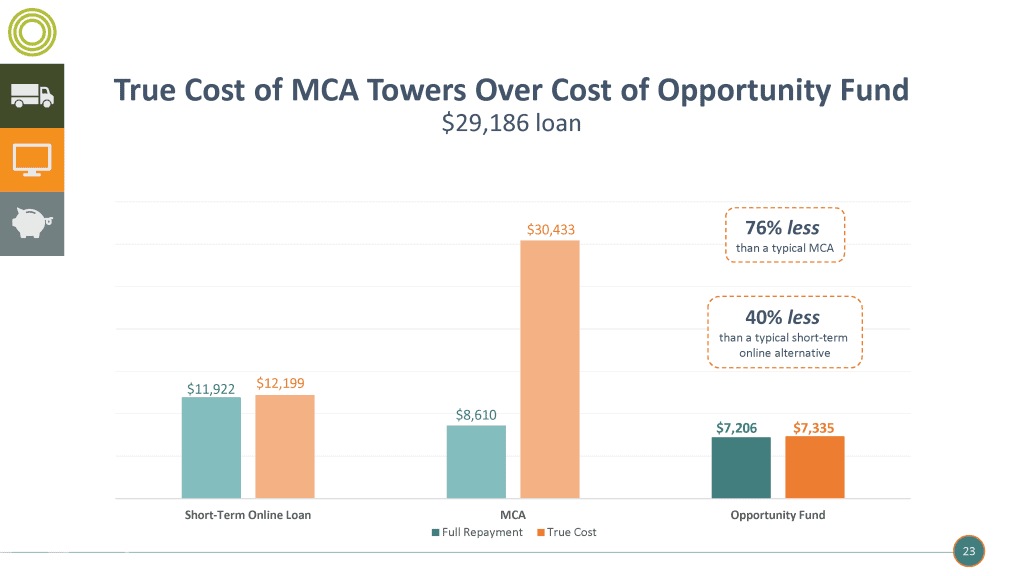

- Our online loans cost 40% less than typical short-term online loans and 76% less than typical merchant cash advances.

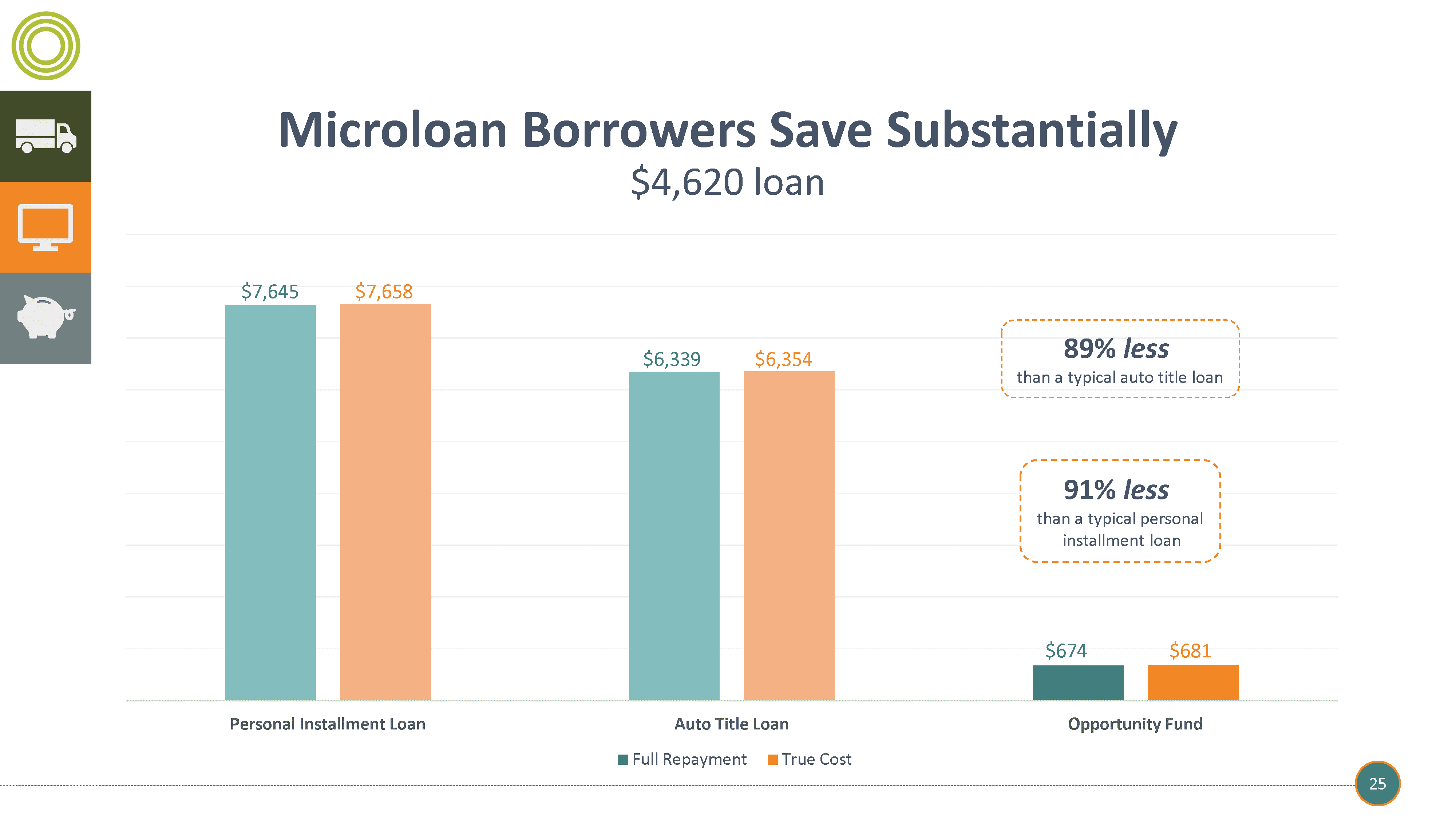

- Our microloans cost 89% less than typical auto title loans and 91% less than typical personal installment loans.

Where Do We Go From Here?

“The True Cost of Capital” research puts dollar amounts on what we already knew – our products save clients money.

And we’re looking to expand our reach by providing $1.2 billion in affordable loans to almost 30,000 small business owners across the country, thereby supporting close to 100,000 jobs and generating $2.3 billion in annual economic activity.

Just imagine what would happen if every entrepreneur had access to affordable credit. Small business owners could invest their savings into marketing and draw more customers, save up a robust emergency fund, or make sure that their children can afford to attend college.

On a macro-level, small business employs 49% of the workforce and is responsible for 2 out of every 3 new private sector jobs. Entrepreneurship is a big creator of wealth, even greater than home ownership. Providing responsible loans to entrepreneurs would have a profound impact on their business survival rates and an even more profound impact on both the job market and the greater economy.

With an $87 billion capital gap amongst underserved small businesses, there’s ample room to innovate so that affordable credit can be made more widely accessible. We’re proud to be leading the way.

Pictured: Shannen of Enos CPR, our first online client through LendingClub. She helps to save lives and teaches others how to do the same.