Creating a Personal Budget

Budgeting is a critical part of being a business owner. But that’s not all you need – you also have to start creating a personal budget.

Budgeting is a critical part of being a business owner. Without a proper budget, you won’t be able to know where to allocate assets, how to manage costs, and how to make business projects. Setting up a concrete budget gives you a road map for day-to-day operations, as well as long-range future planning. But that’s not all you need – you also have to start creating a personal budget.

As a business owner, you may not give as much as much thought to how to manage your personal assets as you do your business ones. The financial skills you learn from starting and heading up your small business can carry over into your personal finances as well. In addition, your personal finances may affect your ability to get loans or lines of credit for your business, since many lenders require personal guarantees for loans to new businesses.

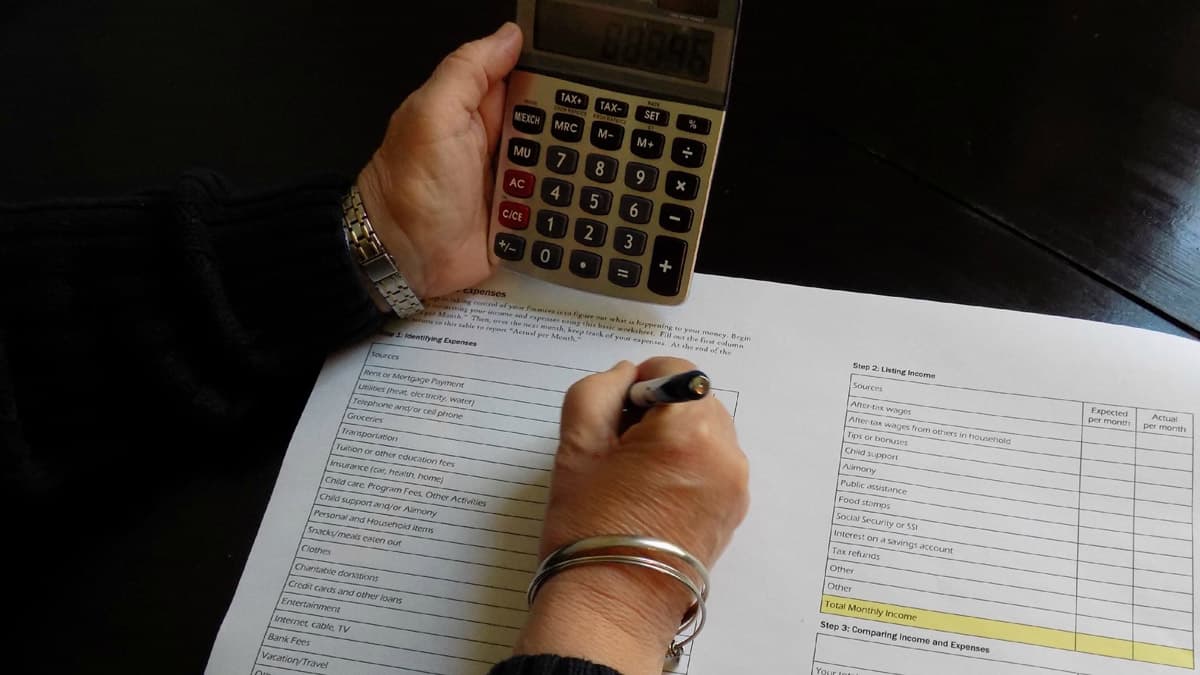

As with a business budget, creating a personal budget is all about tracking your income and expenses. It just takes a few simple steps!

3 Easy Steps To Creating A Personal Budget

A monthly budget can help you manage debt, know where to cut back, and where to prioritize your funds. With a limited amount of money to go around, planning where it will go can keep you on track to meet your long-range financial goals.

You can keep track of your monthly budget in whichever way feels organic and useable to you. Some find spreadsheets helpful and others find software like Quicken user-friendly; others prefer the old-fashioned notepad approach. It’s entirely up to you to use the method that you feel most comfortable with. Just be sure to pick one that you’ll stick with.

1. Calculate Your Monthly Income

The first step to creating your personal budget is to calculate your monthly income. Your monthly income is all of the money that comes into your household each month from any source. This income may be from paychecks, wages, your business, dividends, interest, child support or alimony, or income from rental properties or other investments.

At this step, you should also deduct your taxes, Social Security, insurance, and any other withholdings. That will come out of your paycheck automatically, but it may not come out of your investment income, child support, alimony, and other income sources. You’ll need to account for that to avoid overstating your income.

2. Calculate Your Monthly Expenses

The second step to creating your personal budget is to calculate your monthly expenses. This is just as it sounds – what items do you spend money on each month? You will have two categories to consider: 1) Fixed expenses and 2) Variable expenses. Some of these numbers will be exact, but others will be ballpark. The idea here is to figure out how much you have to spend and how much you can afford to spend.

Fixed expenses are bills that don’t change each month. For example, your rent, your car payment, and your cable bill are all the same each month. You may also have student loans or other types of fixed payments. It’s easy to project what those costs will be since they are static.

Variable expenses are those that fluctuate each month, such as your grocery bills, utilities, or gas bills. These are harder to calculate. Experts recommend that to determine your variable expenses, you look at your bank statements or credit card statements over the span of several months for costs such as transportation, household items, food costs, and entertainment. Then you can determine an average amount over the span of several months to give you a clearer picture of your variable expenses. For example, you can look at your total expenditures on groceries for the last 6 months and find that you spend an average of $500 per month.

You will also want to include periodic expenses, such as auto or health insurance, in your calculations. Then you can divide it up to get a monthly expense. For example, if you pay $600 for car insurance every 6 months, you can add $100 to your expenses each month. That way you’re putting away enough to make the payment when it comes up.

3. Compare Your Monthly Expenses To Your Income

Your third step to creating a personal budget is to subtract your monthly expenses from your income. Hopefully, you’ll find that you have money left over each month. If not, it’s time to reevaluate your spending patterns to try and correct the overages. You may decide to spend less on restaurants, for example, or find a less expensive car insurance option. You may be able to refinance debt and get lower payments. You can also find a way to earn more income, like taking on freelance work or asking for more hours or shifts.

If you have money left over, you can choose what to do with it. Save it, invest it, or spend it on something fun. Experts advise having a cushion of personal savings for an emergency spending fund. If you suddenly need a major car repair, for example, that money is there for you.

Make A Financial Plan

Now that you have your budget set up, take a look at your personal finances. The goal is to make sure your monthly income exceeds your expenses so that you can put some money away and you don’t get caught up in credit card debt or other types of debt.

Think about your long-term goals. Are you saving up to put a kid through college or to buy a new home? Do you have credit card debt or medical debt to pay off? Write those goals down and include them in your budget. Make a commitment to set aside or pay off a certain amount every month. With a concrete plan, it’s much easier to reach your financial goals.

Conclusion

Calculating your personal budget is an important step toward financial autonomy. Moreover, it can be a useful step to earning financing for your small business, should you need to present your personal assets and income as collateral to earn a business loan. Make the effort to be financially savvy with creating a personal budget for a bright financial future.

Learn More

When it comes to your finances, you want clear guidance and easy-to-implement tools based on your unique needs. Visit Learn with AOF to get started strengthening your financial management and meeting your goals.

Experience a different kind of financial education. Learn with AOF has flexible, on-demand courses developed by small business owners, for small business owners. Learn on your schedule, with no time commitment or limit. Save your progress any time to fit courses into your busy schedule.

Learn more about Accion Opportunity Fund (AOF) and how we advise small businesses and give them the support and tools to grow.