We Need to Get It Right: SSBCI and Its Role in Our Economic Recovery

Accion Opportunity Fund responded to the Department of Treasury’s request for comment regarding implementation of the State Small Business Credit Initiative (SSBCI)

On June 4, 2021, Accion Opportunity Fund responded to the US Department of Treasury’s request for comment regarding implementation of the State Small Business Credit Initiative (SSBCI). First implemented after the 2008 Great Recession, SSBCI was re-established in the wake of COVID-19 to support small businesses through state, tribal, and territory credit and investment programs. As our nation’s small businesses heal from the economic fallout of COVID-19, SSBCI will be critical in driving more affordable, responsible capital into the hands of entrepreneurs, especially to those most underserved by traditional lenders and institutions before and during the pandemic (women, immigrants, and entrepreneurs of color). Accion Opportunity Fund recommends that US Treasury prioritize Community Development Financial Institutions (CDFIs) input and activity in these programs, require lenders to abide by responsible lending protocol, and provide ample staff time and guidance so as to ensure the success of the program. We believe that these recommendations (further summarized below) will help the most vulnerable small businesses in our nation and help propel our economy towards full recovery.Access our full comment letter now

Background

The State Small Business Credit Initiative (SSBCI) was created through the Small Business Jobs Act of 2010 following the Great Recession and was implemented across the nation. SSBCI enabled states with the flexibility to deploy a limited menu of high impact credit enhancement programs — capital access programs, guarantees, collateral support programs, loan participations and/or venture funds. SSBCI is a proven mechanism and a highly efficient way to use government funds to leverage private sector capital. For every $1 provided by the federal government, the initiative required that at least $10 in capital be leveraged from the private sector.Small business owners are looking beyond PPP and grants to other sources of affordable capital to help sustain their business through 2021 and beyond. California and states across the country have the infrastructure in place to leverage SSBCI funds quickly and equitably to provide relief to small businesses. Implementing SSBCI quickly, and with strong Community Development Financial Institution (CDFI) partnerships, will enable states to relaunch and innovate their programs and lenders to secure needed capital to begin lending. Together we can build an equitable recovery for our small businesses.

Accion Opportunity Fund

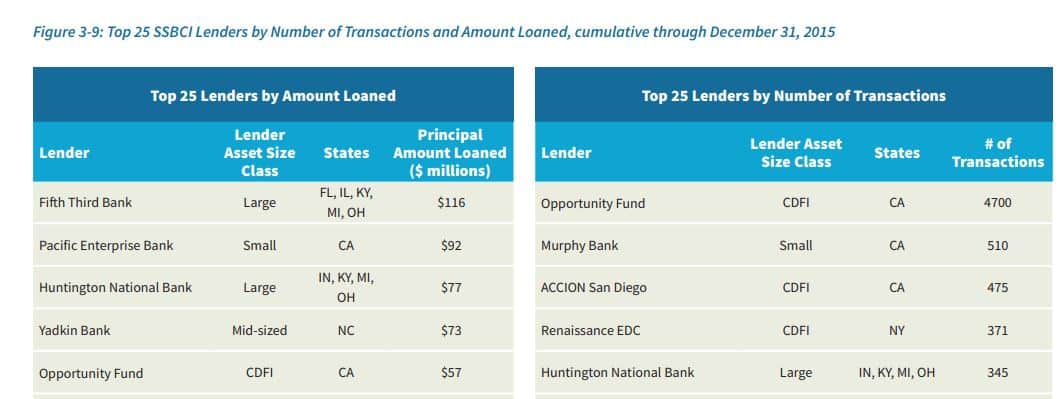

Between 2010-2015, California — Accion Opportunity Fund’s predominant market — received $167.8 million in SSBCI funding which enabled $793 million in small business lending across the state and supported over 70,000 jobs. California opted to invest these federal dollars into capital access, collateral support and guarantee programs, ensuring that a wide range of small businesses had access to appropriate funding. Accion Opportunity Fund was the most prolific user of the original SSBCI Capital Access Program nationally in terms of number of transactions, accounting for over 4,700 transactions across California, for an average loan of $12,000.

SSBCI Recommendations to Better Reach and Fund Disadvantaged Small Businesses and Very Small Businesses

Robust CDFI participation is essential to ensuring socially and economically disadvantaged small businesses, and very small businesses, are served with SSBCI funding. CDFI participation under SSBCI 1.0 varied widely. Without a centralized effort to encourage CDFI participation, some states may default solely to programs and partnerships from SSBCI 1.0 (many of which did not actively encourage CDFI participation) which would be contrary to congressional intent and ignore the realities of the changing small business landscape. Therefore, Accion Opportunity Fund offers the following CDFI-specific recommendations:

- Require that each state submit a robust CDFI Participation Plan highlighting how they will facilitate and encourage CDFI participation, including but not limited to:

- Documented past experience and lessons learned with CDFIs in SSBCI 1.0 and/or other joint efforts

- How selected programs will utilize CDFI capacity and meet the needs of socially and economically disadvantaged communities including in rural areas

- Specific outreach methods proposed, including language accessibility for any state programs

- Technical assistance funding plans and how they align with CDFI participation plan

- Require states to deem all certified CDFIs as eligible financial institutions for all SSBCI programs and avoid inadvertent or explicit bars. Ensure outdated domicile requirements do not inadvertently restrict access to CDFIs operating within a state who are not headquartered or domiciled there.

- Develop specific guidance for and incentivize a CDFI-specific model program type, including:

- Clarify that investments in CDFIs for small business lending meet deployment or “obligation” requirements for subsequent allocations, whether funds are used as loan capital or loan loss reserves

- Lower or eliminate leverage requirements for CDFI-specific programs, count fund redeployment towards leverage ratio

- Encourage states to provide significant flexibility to CDFIs on credit criteria

- Prioritize a higher number of transactions (as opposed to only measuring dollars deployed) as well as their impact demographics of reaching socially or economically disadvantaged individuals

- Clarify that robust CDFI partnerships will be given favorable consideration when allocating $1B in incentive funds to states to reach disadvantaged populations.

- Create an Advisory Board within Treasury made up of CDFIs and other community-based organizations to ensure SSBCI meets the needs of disadvantaged and very small businesses. Utilize this body to highlight best practices and lessons learned between states and their partners regarding outreach, program offerings, partner selection and technical assistance. Encourage states to develop and maintain similar accountability bodies as part of their CDFI Participation and Technical Assistance Plans.

Authorize the CDFI Fund to automatically count all SSBCI transactions towards a CDFI’s target market, regardless of geography (as was done for PPP loans).

- Allow refinancing of non-SSBCI eligible debt by eliminating the requirement that the original lender must be eligible to make a loan under SSBCI. The Treasury’s Office of Inspector General interpretation under SSBCI 1.0 prevented states from allowing refinancing as an eligible use of SSBCI Funds. Refinancing high-cost small business debt is a critical component of economic recovery and most likely to benefit very small and BIPOC owned businesses. In addition, remove the burden on lenders to prove the original use of proceeds so as to ensure a more cost and time efficient refinancing process for the borrower.

- Require all SSBCI participating non-bank lenders who are not certified CDFIs attest to and abide by the Small Business Borrowers’ Bill of Rights (BBoR) established by the Responsible Business Lending Coalition (RBLC) to prevent predatory lending and abuses. The BBoR identifies six fundamental rights that all small business owners seeking financing deserve and outlines how lenders, brokers and lead generators should uphold and protect these rights. The BBoR outlines that small business owners have the right to transparent pricing and terms, non-abusive products, responsible underwriting, fair treatment from brokers, inclusive credit access and the right to fair collections practices.

The RBLC requires that all signatories to the BBoR attest, with the signature of the Chief Executive Officer of the company, that it upholds all of the practices identified in the BBoR. These rights were developed by Accion Opportunity Fund and our founding partners at the RBLC.

- Complement but do not duplicate other federal efforts to provide technical assistance, such as the newly funded SBA Community Navigator program. Channel technical assistance funds to states provided they have strong CDFI participation and TA plans, as well as to the Minority Business Development Agency.

- Consider the relevance of these recommendations for programs administered by non-state entities such as Tribal governments, municipalities or multi-state consortia. While many of these recommendations may be relevant and appropriate for non-state SSBCI efforts, others may not be due either to the scale of the effort or other existing mechanisms for community input and engagement.

SSBCI Recommendations to Foster Responsible Lending Practices

- Ensure that a clear and consistent methodology is used for disclosing the cost and terms, in the form of APR, of all SSBCI financing products offered, by all lenders. We recommend that the Treasury implement basic uniform disclosure requirements that provide borrowers with the essential information the Federal Reserve has identified as necessary to compare and understand the full costs of borrowing. These disclosures are embodied in the recently-passed New York state TILA legislation, as well as the truth in lending disclosure provisions included in the Small Business Lending Disclosure Act (HR 7921) introduced in the 116th Congress and poised to be reintroduced in the 117th.

- Prioritize implementation of the 4506-T and the IRS adoption of the Application Program Interface (API). The Taxpayers First Act, signed into law in 2019, required the IRS develop an automated system to receive third-party income verification forms (4506-T) which would allow the IRS to instantly transfer a business borrower’s data to a lender and in doing so facilitate timely and efficient small business lending transactions. However the IRS has not yet adopted the API technology needed to instantly transfer the data collected via the 4506-T form.

SSBCI Recommendations for Effective State Administration

- Ensure adequate US Treasury staffing levels to respond promptly to revised plans submitted by states, to meet the evolving states’ needs in a timely manner.

- To the extent possible, provide more concrete guidance to states on issues identified as challenges with OIG under SSBCI 1.0 to ensure states can be innovative and responsive to local needs.

Are you looking for funding for your business? Explore our Small Business Loans or get in touch with us to learn more.Sources

- https://www.treasury.gov/resource-center/sb-programs/Documents/SSBCI%20Program%20Evaluation%202016%20-%20Full%20Report.pdf

- https://www.treasury.gov/resource-center/sb-programs/Documents/SSBCI%20Program%20Evaluation%202016%20-%20Appendices.pdf

- These recommendations specifically focus on administration by states, however they may also be relevant for other entities such as Tribal governments, municipalities and multi-state collaboratives.

- Legislative Language Stricken: “CDFI AND MDI PARTICIPATION PLAN.—The Secretary may not approve a State to be a participating State unless the State has provided the Secretary with a plan detailing how minority depository institutions and community development financial institutions will be encouraged to participate in State programs.

- According to the Federal Reserve’s 2021 Small Business Credit Survey 14% of African American firms surveyed sought out MCAs, double that of White firms (7%). Asian and Hispanic firms each sought out MCAs at a rate of 10%. (https://www.fedsmallbusiness.org/survey/2021/report-on-employer-firms)

- https://www.federalreserve.gov/publications/2019-november-consumer-community-context.htm