How Much Do a Term Loan and Line of Credit Cost?

Term loans and lines of credit are great small business financing options, but how much does a line of credit cost? What about a term loan?

External financing can be a great way to help you reach your business goals, but with so many different terms, rates, and fees, it can be difficult to compare financing options. So, how much does a line of credit cost, and how does that compare to the cost of a term loan?

Term Loan Vs Line of Credit:Typical Uses

While they are both types of debt capital, lines of credit and term loans have very different uses in small business finance. For a deep dive into the differences between term loans and lines of credit, check out our article: Term Loans and Lines of Credit: What’s the Difference?

In general, lines of credit and term loans are best used for the following small business expenses:

Line of Credit

- Inventory

- Payroll

- Seasonal working capital

- Short term costs

Term Loan

- Equipment

- Real estate

- Start-up capital

- Larger costs

- Longer time needed to repay

Term Loan and Lines of Credit Cost Comparison

, annual fees, principal, and credit scores can make for a confusing time when it comes to comparing term loan and line of credit cost. To help you determine the best financing option for your business, we’ve broken the costs down into a side-by-side comparison.

!function(e,i,n,s){var t=”InfogramEmbeds”,d=e.getElementsByTagName(“script”)[0];if(window[t]&&window[t].initialized)window[t].process&&window[t].process();else if(!e.getElementById(n)){var o=e.createElement(“script”);o.async=1,o.id=n,o.src=”https://e.infogram.com/js/dist/embed-loader-min.js”,d.parentNode.insertBefore(o,d)}}(document,0,”infogram-async”);

What is the Prime Interest Rate?

Prime or the prime interest rate

is the prevailing interest rate that traditional banks charge to customers with excellent credit scores. The prime rate is usually the same as the interest rate set by the US Federal Reserve. If your credit score could use some improvement, you will likely be charged more than prime.

Merchant Cash Advance (MCA)

Merchant Cash Advances or MCA are another common type of business financing. When a small business owner takes out a merchant cash advance, they’re given cash up front, which they repay through a predetermined percentage of their daily debit and credit card sales. This can be a great lending option for businesses with fairly stable debit and credit card sales, but it is also a common vehicle for predatory lending practices. If you are considering a Merchant Cash Advance, make sure you read and understand the terms carefully before agreeing to the loan.

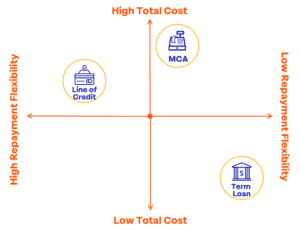

Cost vs Flexibility

All three of these popular loan options have pros and cons that you need to consider before choosing a loan for your business. The chart below helps you consider the total cost of a loan verses the flexibility of it’s repayment terms (i.e. how much and how often you will make payments).

Which is Right for Your Business?

Comparing the cost of term loans and lines of credit can feel a bit like comparing an apple and an orange. If you are considering an MCA as well, the decision can get even more confusing. The best way to decide what is right for your business is to start with what your business can afford in terms of monthly or weekly payments, what the loan will be used for, and what loan terms work best for your business’s financial situation. Once you have that list, you can start comparing it to different financing options to find the best fit for your business.

Financing with Accion Opportunity Fund

If you do decide that a term loan is right for you and your business, consider working with Accion Opportunity Fund. At Accion Opportunity Fund, our goal is not only to help you get the funding and support you need to launch your business, but to help you grow and thrive once you’ve got your foot in the door. Accion Opportunity Fund is a government-regulated, non-profit financial institution with a mission to help small business owners reach their goals. Find out more about our small business loan program and apply online today.

Disclaimer: Average interest rates and typical loan terms can change rapidly, so please thoroughly check with any provider to confirm rates and terms.

Learn More About Business Financing

When it comes to your finances, you want clear guidance and easy to implement tools based on your unique needs. Visit Accion Opportunity Fund. to get started strengthening your financial management and meeting your goals.

Experience a different kind of financial education. Learn with AOF has flexible, on-demand courses developed by small business owners, for small business owners. Learn on your schedule, with no time commitment or limit. Save your progress any time to fit courses into your busy schedule.